© FBDi

Components |

German component distribution market grew 12% in 4Q17

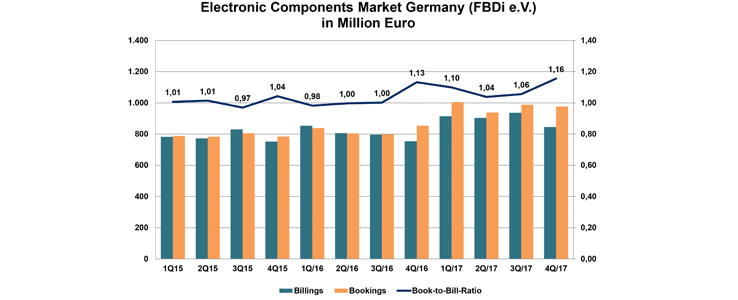

2017 was a record-breaking year for the German component distribution, measured in terms of turnover. In the fourth quarter sales grew by 12% to EUR 845 million, says the FBDi.

Although this is 10% less than in the third quarter, it is still impressive. Considering the very stable order situation (plus 14% to EUR 976 million and a book-to-bill rate of 1.16) the first quarter of 2018 could remain positive.

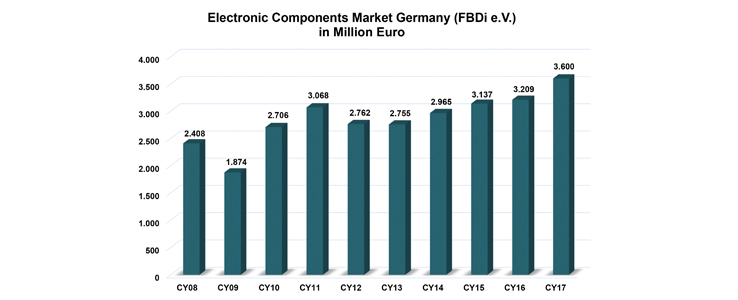

For the full year of 2017 companies registered with the Fachverband Bauelemente Distribution (FBDi e.V.) in Germany reported a sales plus of 12% to EUR 3.6 billion and incoming orders of EUR 3.91 billion – a record result. Apart from shortage and price increases 2017 was further affected by fluctuations in exchange rates (Dollar/Euro), which nearly compensated across all quarters.

Concerning the different component types they show differing trends: Whereas semiconductors grew by 11.4% to EUR 2.41 billion, the sales of passive components grew more slowly by 10.3% to EUR 488 million, and the sales of electromechanics rose by 25.5% to EUR 377 million. Furthermore power supplies grew strongly by 15.8% to EUR 98 million, whereas remaining components did not fulfil expectations. The breakdown of distribution turn-over remained nearly unchanged: semiconductors 69.8%, passive components 13.6%, electromechanics 10.5%, power supplies 2.7%, and all others together 3.4%

FBDi Chairman of the board, Georg Steinberger said: "Under normal circumstances a book-to-bill rate of 1.16 for the year would indicate a solid growth in 2018. But, as some customers postpone or cancel their orders depending on shortage and availability, there is a possibility for a small disillusion throughout the year. FBDi expects a solid but not groundbreaking year 2018."

"Regarding a further outlook, the important factor is the component production, and if a relaxation can be expected. Concerning the customers the demand seems to remain high, less driven by availability (and hence the risk of double orders) but by innovation and good economy in all industries,” Steinberger continued.