© qualcomm © NXP

Business |

Qualcomm and NXP - one deal, multiple possibilities

Yesterday the world saw the start of the worlds biggest semiconductor deal to date – Qualcomm acquiring NXP in a deal valued at USD 47 billion, but what kind of company will we see following the completion of the acquisition?

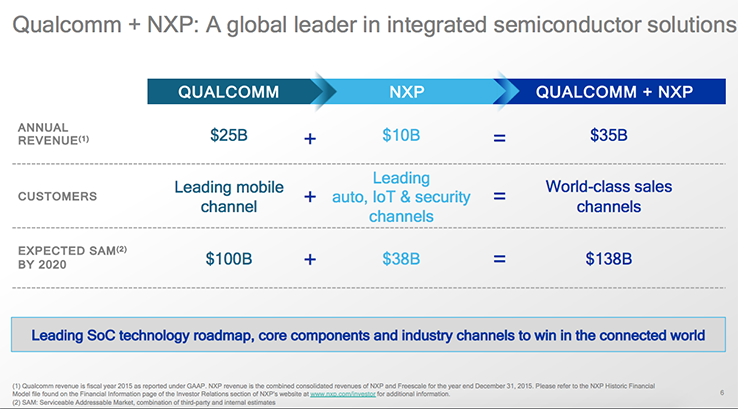

Both companies have their strengths, some of these overlap while other don’t. But firstly, lets talk numbers. The combined company is expected the generate annual revenues of USD 35 billion – of which USD 25 billion stem from Qualcomm and USD 10 billion from NXP (these figures are comprised from Qualcomm’s fiscal 2015 and NXP’s fiscal 2015 [consolidating NXP and Freescale revenues).

The customer portfolio of both companies cover the Mobile, Automotive, IoT and Security segments. Combined, the new company will be able to command a rather large portion of the addressable market. In its Investor Deck Qualcomm states, that it expects the Serviceable Addressable Market (SAM) to reach USD 100 billion by the end of the decade. Add to that some USD 35 billion for NXP and you look at a potential SAM of USD 138 billion by 2020.

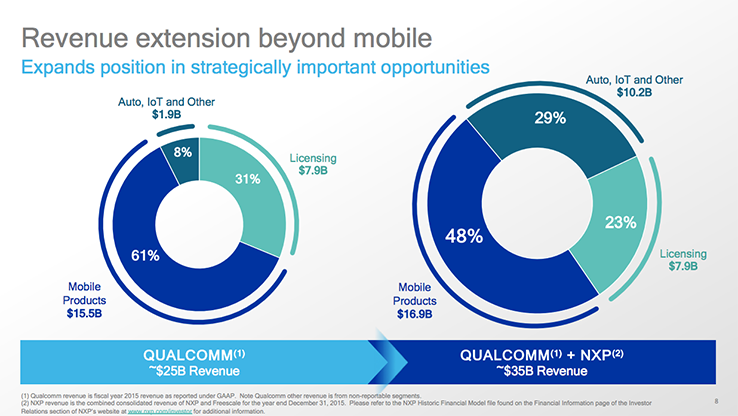

Qualcomm generates its revenue through three main categories; Mobile Products (61% or USD 15.5 billion), Licensing (31% or USD 7.9 billion) and Automotive, IoT, etc. account for the remaining 8 % (USD 1.9 billion).

The Dutch heavyweight generates its USD 10 billion in revenue through: Mobile Products (48% or USD 16.9 billion) Licensing (23% or USD 7.9 billion) and the remaining 29 % (USD 10.2 billion) come from Automotive, IoT, etc.

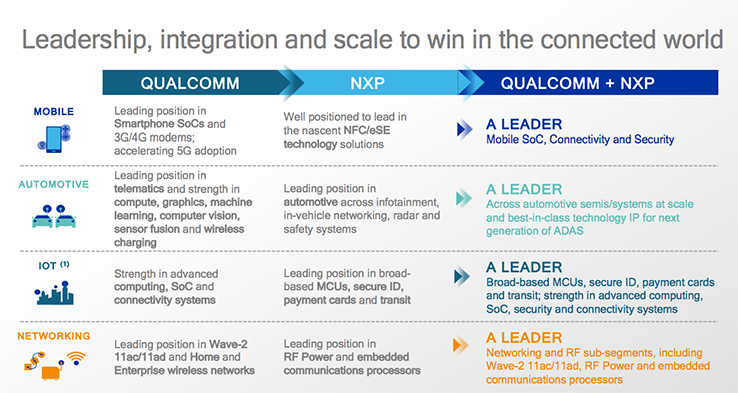

Qualcomm’s (very) strong position in smartphone SoC’s and 3G/4G modems and NXP comfortable position in the field of NFC/eSE make for interesting synergies. Both companies have a stable footing on the automotive market – Qualcomm in telematics, graphics, machine learning and NXP across infotainment and in-vehicle networking, radar and safety systems.

As Fortune stated in a report, Qualcomm isn’t just diversifying its offering by acquiring NXP. There are complementary strengths between the companies. Developing and designing product lines for autonomous cars and connected devices in the growing IoT arena suddenly becomes or lot more appealing.

Which of the above stated segments will emerge as the most profitable for the new behemoth remains pure speculation. However, a fair guess would be the Automotive segments. Always keeping in mind the fact that Freescale is – sort of – part of the new giant too.

----

Images: © Qualcomm