© ic insights

Analysis |

Sensor/Actuator sales take off as price erosion eases

After several years of low and inconsistent growth rates primarily caused by intense pricing pressure, the market for semi sensors and actuators finally caught fire in 2016 with several of its largest product categories recording strong double-digit sales increases in the year.

In addition to the easing of price erosion, substantial unit-shipment growth in sensors and actuators continues to be fed by the spread of intelligent embedded control, new wearable systems, and the expansion of applications connected to the Internet of Things, says market researcher IC Insights.

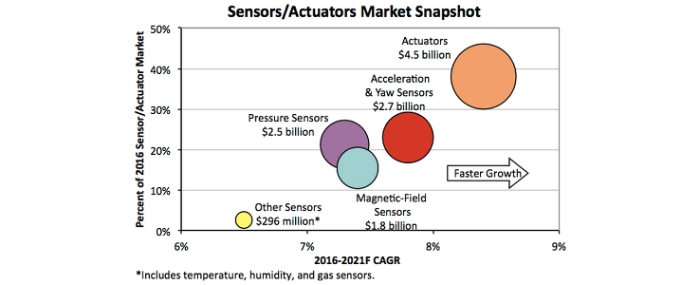

The report shows worldwide sensor sales grew 14 percent in 2016 to a record-high USD 7.3 billion, surpassing the previous annual peak of USD 6.4 billion set in 2015, when revenues increased 3.7 percent. Actuator sales climbed 19 percent in 2016 to an all-time high of USD 4.5 billion from the previous record of USD 3.8 billion in 2015. The forecast for total sensor sales is rising by a compound annual growth rate (CAGR) of 7.5 percent in the next five years, reaching USD10.5 billion in 2021, while actuator dollar volumes are expected to increase by a CAGR of 8.4 percent to nearly USD 6.8 billion in the same timeframe.

The sensor/actuator market ended four straight years of severe price erosion in 2016 and finally benefitted from strong unit growth. The average selling price (ASP) of sensors and actuators declined by -0.9 percent in 2016 versus an annual average of -9.3 percent during the four previous years (2012-2015), says IC Insights. All sensor product categories and the large actuator segment registered double-digit sales growth in 2016. It was the first time in five years that sales growth was recorded in all sensor/actuator product categories, partly due to the easing of price erosion but also because of continued strong unit demand worldwide. Sensor/actuator shipments grew 17 percent in 2016 to a record-high of 20.3 billion units from 17.4 billion in 2015, when the volume also increased 17 percent.

Strong 2016 sales recoveries occurred in acceleration/yaw-rate motion sensors (+15%), magnetic-field sensors and electronic compass chips (+18%), and the miscellaneous other sensor category (+20%) after market declines were registered in 2015. Sales growth also strengthened in pressure sensors, including MEMS microphone chips, (+10%) and actuators (+19%) in 2016. The report forecasts sales of acceleration/yaw sensors growing 9 percent in 2017 to about USD 3.0 billion, magnetic-field sensors (and compass chips) rising 8 percent to nearly USD 2.0 billion, and pressure sensors increasing 8 percent to USD 2.7 billion this year. Actuator sales are projected to grow 8 percent in 2017 to about USD 4.9 billion.

About 82 percent of the sensors/actuators market’s revenues in 2016 came from semiconductors built with microelectromechanical systems (MEMS) technology—meaning pressure sensors, microphone chips, acceleration/yaw motion sensors, and actuators that use MEMS-built transducer structures to initiate physical action in a wide range of devices, including inkjet printer nozzles, microfluidic chips, micro-mirrors, and surface-wave filters for RF signals. MEMS-built products represented 48 percent of total sensor/actuator shipments in 2016, or about 9.8 billion units last year.

MEMS-based product sales climbed 15.4 percent in 2016 to a record-high USD 9.7 billion after rising 5.1 percent in 2015 and 5.8 percent in 2014. Some inventory corrections and steep ASP erosion in MEMS-built devices have suppressed revenue growth in recent years, but this group of products—like the entire sensors/actuator market—is benefitting from increased demand in new wearable systems, IoT, and the rapid spread of intelligent embedded control, such as autonomous automotive features rolling into cars. MEMS-based sensors and actuator sales are forecast to rise 7.9 percent in 2017 to USD 10.5 billion and grow by a CAGR of 8.0 percent in the 2016-2021 period to USD 14.3 billion.

-----

More information can be found at IC Insights.