© stevanovicigor dreamstime.com

Analysis |

Electronic equipment are idling as new growth drivers get in line

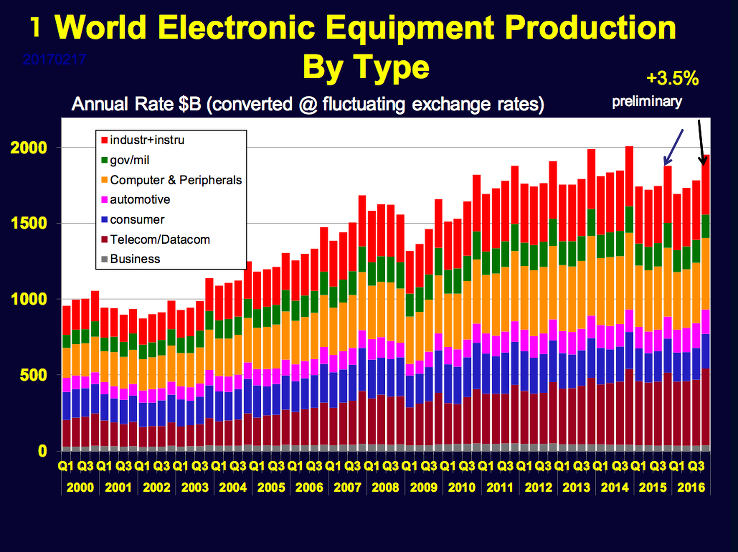

World electronic equipment production value (Chart 1) grew 3.5% y/y in 4Q’16 with Telecom/ Datacom continuing seasonal expansion followed by Computers and Peripherals, says Custer Consulting Group.

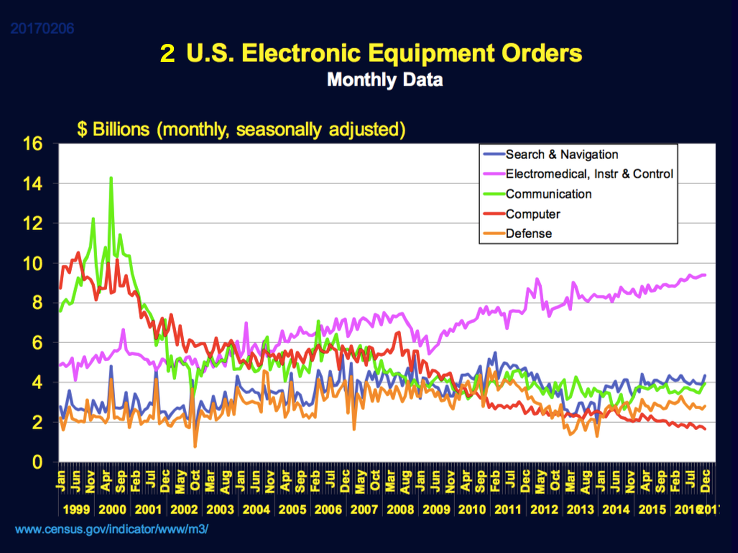

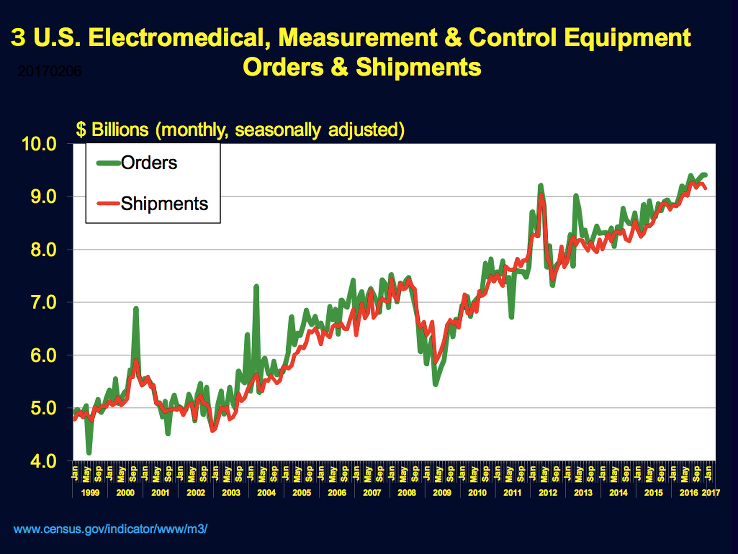

In the U.S., electronic equipment orders (Chart 2) were led by Electromedical and Instrument and Control (Chart 3) while Communication and Search & Navigation are beginning to show some signs of expansion.

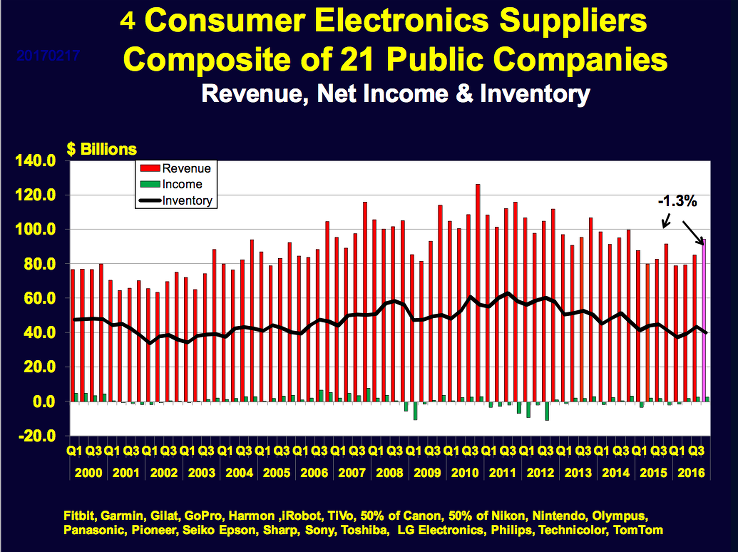

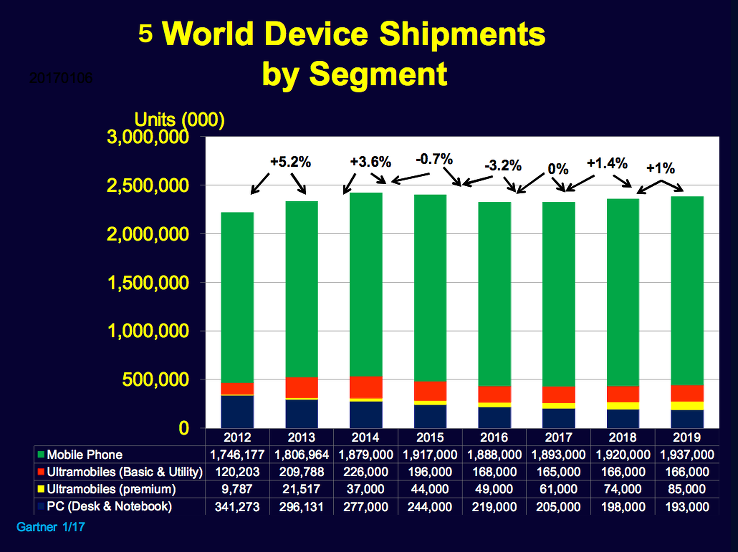

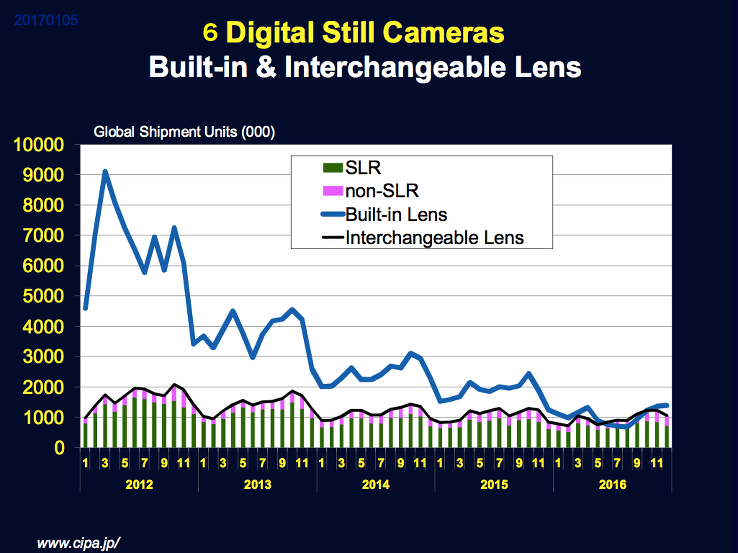

According to a recent article in Reuters, Consumer Electronics demand (Chart 4) will continue to slow as discretionary income shrinks due to rising inflation and tightening credit and further cannibalization of product lines as products, such as cell phones, eliminate need for standalone products such as (Chart 5) cameras (Chart 6) and computers, tablets and smartphones morph and consolidate into mini PCs.

The good news is that there some major growth drivers just around the horizon.

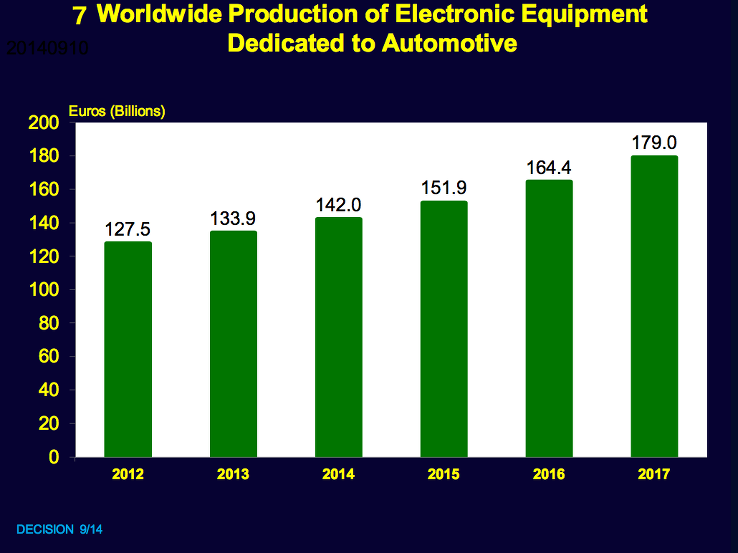

The expansion of electronics content is propelling the Automotive Industry (Chart 7) to add electronic equipment to support efforts to reduce fuel consumption, increase safety and expand connectivity.

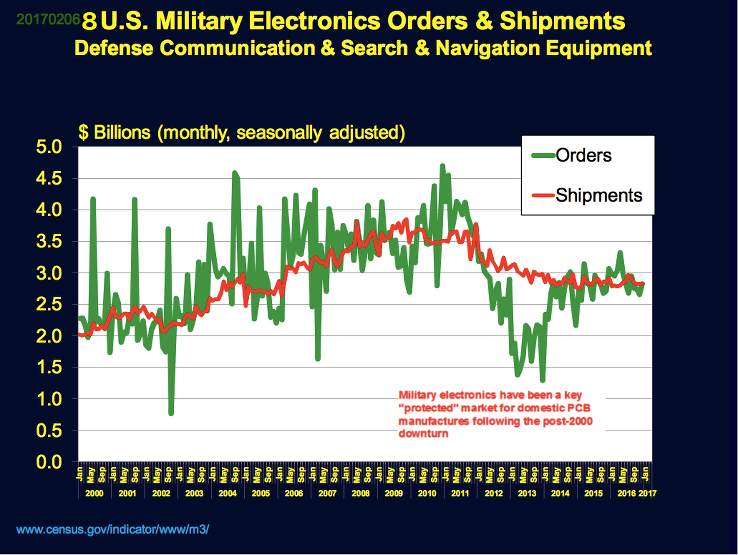

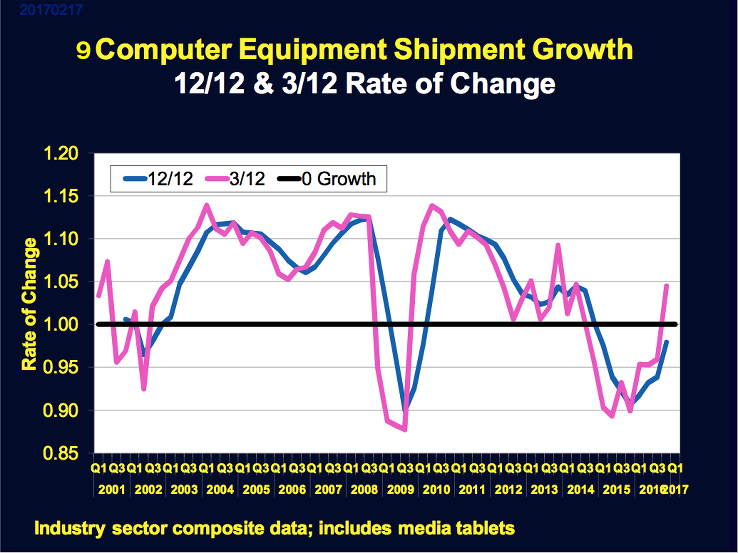

Military electronics (Chart 8) and Business Equipment are looking to benefit from recent political leadership changes in the U.S. and Europe and an expansionary business climate (Chart 9).

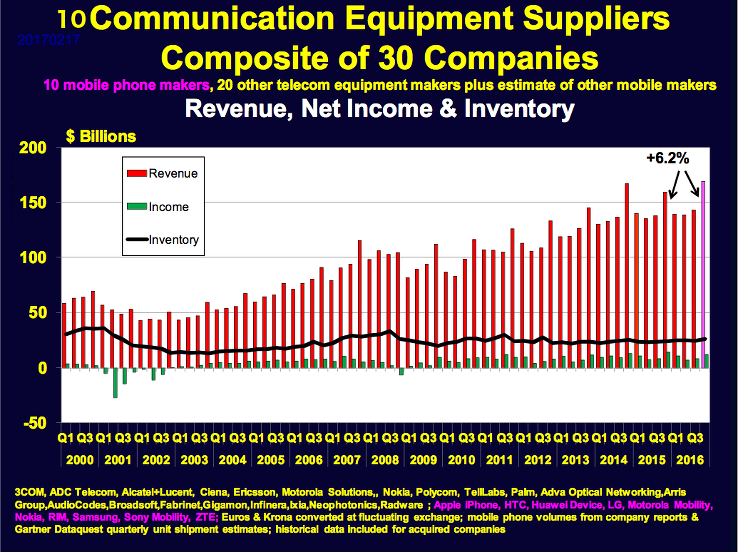

Over the next couple of years, Communication Equipment Suppliers (Chart 10) will be preparing for the next big expansion, which will expand demand for more robust processing power and storage to accommodate large increases of data usage generated by 5G and Internet of Things.

-----

Jonathan Custer-Topai is Vice-President of © Custer Consulting Group, which provides market research, business analyses and forecasts on a variety of subjects.