© designersart dreamstime.com

Analysis |

Taiwan passes South Korea to become leader IC wafer fab capacity

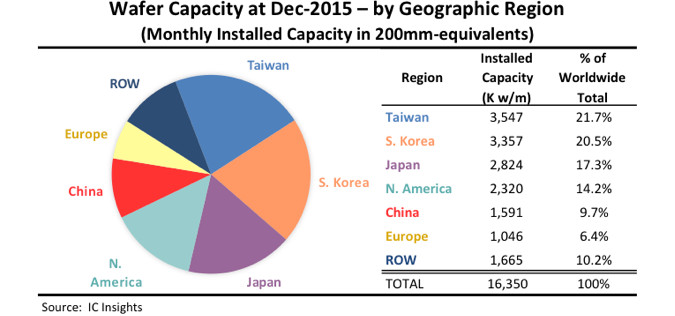

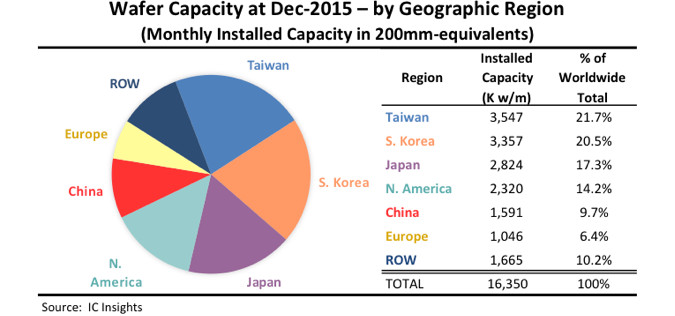

As of Dec-2015, Taiwan led all regions/countries in wafer capacity with nearly 22% of worldwide IC capacity installed in the country.

The chart breaks down the world’s installed monthly wafer production capacity by geographic region (or country) as of December 2015. Each regional number is the total installed monthly capacity of fabs located in that region regardless of the headquarters location for the companies that own the fabs. For example, the wafer capacity that South Korea-based Samsung has installed in the U.S. is counted in the North America capacity total, not in the South Korea capacity total.

Taiwan surpassed South Korea in 2015 to become the largest capacity holder after having passed Japan in 2011. China became a larger wafer capacity holder than Europe for the first time in 2010.

For wafers 150mm in diameter and smaller, Japan was the top region in terms of the amount of capacity. The fabs running small size wafers tend to be older and typically process low-complexity, commodity type products or specialized devices.

The capacity leaders for 200mm wafers were Taiwan and Japan. There have been many 200mm fabs closed over the past several years, but not in Taiwan and that resulted in the country becoming the largest source of 200mm capacity beginning in 2012. With Taiwan being home to most of the IC industry’s foundry capacity, the country’s share of 200mm capacity will likely rise further in the coming years.

For 300mm wafers, South Korea was at the forefront, followed by Taiwan. Taiwan lost its position as the leading supplier of 300mm wafer capacity in 2013. That was in large part because ProMOS closed its large 300mm fabs, but it was also due to Samsung and SK Hynix continuing to expand their fabs in South Korea to support their high-volume DRAM and flash businesses.

-----

Images: © IC Insights

Taiwan surpassed South Korea in 2015 to become the largest capacity holder after having passed Japan in 2011. China became a larger wafer capacity holder than Europe for the first time in 2010.

For wafers 150mm in diameter and smaller, Japan was the top region in terms of the amount of capacity. The fabs running small size wafers tend to be older and typically process low-complexity, commodity type products or specialized devices.

The capacity leaders for 200mm wafers were Taiwan and Japan. There have been many 200mm fabs closed over the past several years, but not in Taiwan and that resulted in the country becoming the largest source of 200mm capacity beginning in 2012. With Taiwan being home to most of the IC industry’s foundry capacity, the country’s share of 200mm capacity will likely rise further in the coming years.

For 300mm wafers, South Korea was at the forefront, followed by Taiwan. Taiwan lost its position as the leading supplier of 300mm wafer capacity in 2013. That was in large part because ProMOS closed its large 300mm fabs, but it was also due to Samsung and SK Hynix continuing to expand their fabs in South Korea to support their high-volume DRAM and flash businesses.

-----

Images: © IC Insights

Taiwan surpassed South Korea in 2015 to become the largest capacity holder after having passed Japan in 2011. China became a larger wafer capacity holder than Europe for the first time in 2010.

For wafers 150mm in diameter and smaller, Japan was the top region in terms of the amount of capacity. The fabs running small size wafers tend to be older and typically process low-complexity, commodity type products or specialized devices.

The capacity leaders for 200mm wafers were Taiwan and Japan. There have been many 200mm fabs closed over the past several years, but not in Taiwan and that resulted in the country becoming the largest source of 200mm capacity beginning in 2012. With Taiwan being home to most of the IC industry’s foundry capacity, the country’s share of 200mm capacity will likely rise further in the coming years.

For 300mm wafers, South Korea was at the forefront, followed by Taiwan. Taiwan lost its position as the leading supplier of 300mm wafer capacity in 2013. That was in large part because ProMOS closed its large 300mm fabs, but it was also due to Samsung and SK Hynix continuing to expand their fabs in South Korea to support their high-volume DRAM and flash businesses.

-----

Images: © IC Insights

Taiwan surpassed South Korea in 2015 to become the largest capacity holder after having passed Japan in 2011. China became a larger wafer capacity holder than Europe for the first time in 2010.

For wafers 150mm in diameter and smaller, Japan was the top region in terms of the amount of capacity. The fabs running small size wafers tend to be older and typically process low-complexity, commodity type products or specialized devices.

The capacity leaders for 200mm wafers were Taiwan and Japan. There have been many 200mm fabs closed over the past several years, but not in Taiwan and that resulted in the country becoming the largest source of 200mm capacity beginning in 2012. With Taiwan being home to most of the IC industry’s foundry capacity, the country’s share of 200mm capacity will likely rise further in the coming years.

For 300mm wafers, South Korea was at the forefront, followed by Taiwan. Taiwan lost its position as the leading supplier of 300mm wafer capacity in 2013. That was in large part because ProMOS closed its large 300mm fabs, but it was also due to Samsung and SK Hynix continuing to expand their fabs in South Korea to support their high-volume DRAM and flash businesses.

-----

Images: © IC Insights