© lavitreiu-dreamstime.com

Analysis |

How suppliers rank in opto, sensors/actuators, and discretes

Weak Japanese yen hits major optoelectronics and discretes companies in Japan and lowers overall O-S-D dollar sales growth in 2013.

Companies selling optoelectronics continue to dominate the top 30 sales ranking of suppliers serving semiconductor markets outside of traditional integrated circuit products, according to IC Insights’ 2014 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes. The report shows 26 of the top 30 O-S-D suppliers selling optoelectronics, and among those companies, 16 are shipping light-emitting diodes (LEDs) for high-growth applications in solid-state lighting. The 2014 report also shows 16 of the top 30 O-S-D suppliers selling sensor and actuator products—including those made with microelectromechanical systems (MEMS) technology—and 18 companies offering discrete semiconductors.

The 30 largest O-S-D suppliers accounted for 66% of the total USD 58.6 billion in worldwide revenues generated by optoelectronics, sensor/actuator devices, and discretes in 2013, based on IC Insights’ estimates and company reports. The new 2014 O-S-D Report says worldwide optoelectronics sales grew 5% in 2013 to USD 29.2 billion, while the sensors/actuators segment was uncharacteristically flat with no growth last year at USD 8.7 billion, and the discretes market dropped 5% to USD 20.7 billion. In 2013, the top 10 suppliers accounted for 34% of combined O-S-D sales, but it is also worth noting that these companies collectively lost marketshare in 2013 with the sum of their revenues dropping 2%. Suppliers ranked 11-30th in IC Insights’ new report saw combined dollar sales grow 2% in 2013, while the rest of the smaller O-S-D companies collectively gained marketshare last year with a 2% increase in combined sales.

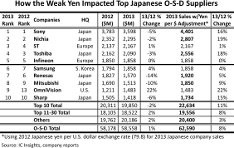

Combined revenues of the top 30 O-S-D companies were flat in 2013 compared to 2012 because of the weak Japanese yen-exchange rate that significantly lowered the dollar-sales value of products sold by semiconductor suppliers based in Japan. The average exchange rate in 2013 was 97.6 yen per U.S. dollar in 2013 versus 79.8 yen/dollar in 2012. Because Japanese companies continue to be major suppliers of O S D products worldwide—especially in optoelectronics and discretes—the 18% decline in the 2013 yen exchange rate significantly held down the growth of the entire O-S-D marketplace, when sales are measured in U.S. dollars. If the stronger 2012 yen exchange rate were used, total O-S-D dollar sales in 2013 would have grown 8% to nearly USD 62.6 billion instead of the 1% increase to USD 58.6 billion when the weaker 2013 yen value is applied.

If the stronger 2012 79.8 yen/dollar exchange rate was used in 2013, O-S-D leader Sony—who is the top image sensor supplier—would have recorded a 16% increase in sales to USD 4.4 billion (versus a 5% decline to about USD 3.6 billion shown in the table above). Other top 10 O-S-D suppliers headquartered in Japan would have seen these improvements in growth using the stronger 2012 exchange rate: LED-leader and major laser maker Nichia (+19% versus -2%); Toshiba (+18% versus -3%); Renesas (+5% versus -14%); Mitsubishi (+9% versus -10%); and Sharp (+15% versus -6%). Images: © IC Insights