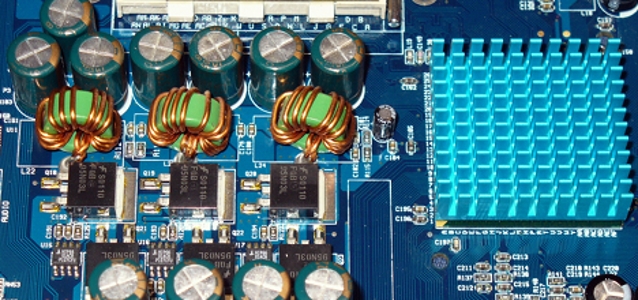

© ermess dreamstime.com

Components |

2Q revenue of EUR 918 million for Infineon

"Revenues and margin have recovered nicely over the past quarter. The trough is behind us", stated Dr. Reinhard Ploss, CEO of Infineon Technologies AG.

"Our order books are filling up, albeit still with a relatively high proportion of short term business. We therefore expect a further rise in revenue and margin in the current quarter", stated Dr. Reinhard Ploss, CEO of Infineon Technologies AG. "As forecast last November, our markets are growing significantly in the second half of the fiscal year. Based on the outlook for the third quarter and on first-half results, we expect to reach the upper end of our guided range for the full year."

Review of Group financials for the second quarter of the 2013 fiscal year

The Infineon Group reported revenue of €918 million for the second quarter of the 2013 fiscal year, 8 percent up on the €851 million recorded in the previous quarter. The increase was partly the consequence of a return to more normalized revenue levels in the Automotive segment (ATV). Second-quarter revenues of the Industrial Power Control (IPC) and Power Management & Multimarket (PMM) were also slightly higher than in the previous quarter. Revenue reported by the Chip Card & Security segment (CCS) was flat quarter-on-quarter.

Segment Result improved by €24 million from €44 million in the first quarter of the 2013 fiscal year to €68 million in the quarter under report. The Segment Result Margin rose from 5.2 percent to 7.4 percent. The improvement in Segment Result primarily reflects higher revenue and continued cost control. The margin expansion was dampened by price reductions in volume purchase agreements that came into effect as usual at the beginning of the calendar year.

Outlook for the third quarter of the 2013 fiscal year

Based on an assumed exchange rate of 1.30 US dollars to the euro (unchanged from the previous quarter), Infineon forecasts third-quarter revenue of about €1 billion, with all segments expected to contribute to revenue growth. The Group's Segment Result Margin for the third quarter is forecast at approximately 10 percent of revenues.

Outlook for 2013 fiscal year: Revenue and Segment Result Margin expected at the upper end of our previously guided range

Based on first-half results and the outlook for the third quarter, the Management Board expects the fiscal year’s revenue decline compared to the previous year at the upper end of the mid-to-high single digit percentage range previously announced. Thus the Segment Result Margin for the 2013 fiscal year is expected to be at the upper end of the mid-to-high single digit percentage range guided thus far.

In terms of revenue growth compared to the previous fiscal year, the ATV, PMM and CCS segments are expected to fare better than the Group average in the fiscal year 2013, whereas IPC is expected to suffer from a revenue decline significantly higher than the Group average.

Revenue of the OOS segment will again fall sharply, as goods and services sold relating to the previously sold Wireline Communications and Wireless mobile phone businesses continue to decrease as planned. This forecast is based on an assumed exchange rate of 1.30 US dollars to the euro.

Investments in the 2013 fiscal year will be in the region of €400 million and compare with a depreciation and amortization expense of approximately €470 million.