© IC Insights

Analysis |

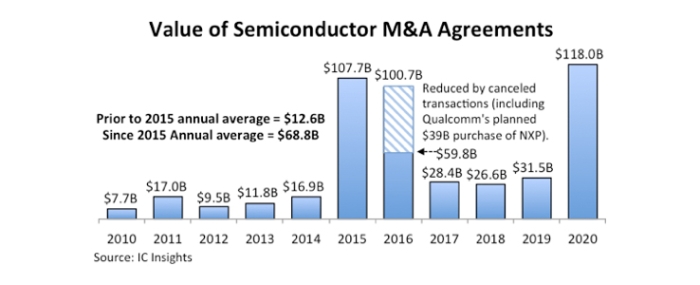

Five mega-deals pushed M&A value to $118B last year

The value of the mergers and acquisitions seen last year within the semiconductor industry set a new record. Five big acquisition announcements and more than a dozen smaller deals in 2020 pushed the total value of M&A agreements in the year to an all-time high of USD 118.0 billion, surpassing the previous record of USD 107.7 billion reached in 2015

The five biggest 2020 M&A agreements—announced in July, September, and October—had a combined value of $94.0 billion, which represented about 80% of the total for the entire year.

The 2H20 wave of huge acquisition agreements began in July when Analog Devices announced it would buy Maxim Integrated Products for USD 21 billion in stock. Analog Devices expects the purchase to be completed by the summer of 2021 and believes the acquisition will boost its marketshare in analog and mixed-signal ICs for automotive systems (especially in autonomous vehicles), power management, and application-specific IC designs. Before the Maxim purchase was announced, semiconductor acquisition agreements in the first six months of 2020 had a combined value of just USD 2.1 billion. The M&A total was only USD 352 million in 2Q20, when the initial surge of Covid-19 virus crisis was sinking the entire global economy.

After a handful of other smaller acquisition agreements in July and August of 2020, graphics processor leader Nvidia blew the M&A lid off the coronavirus-plagued year when it announced a USD 40 billion megadeal in September to buy processor-design technology supplier ARM in the U.K. from holding company SoftBank in Japan. For more than a decade, ARM has licensed nearly all of the central processor technology used in smartphones, and it is expanding its into many other applications—just like Nvidia—including data center systems, automotive automation, robotics, and acceleration of machine learning and artificial intelligence (AI). The prospects of Nvidia owning ARM, its design cores, instruction sets, and microarchitectures has raised concerns among major SoC processor developing companies, which license the technology—including Qualcomm, Samsung, MediaTek, and Apple. To quell concerns, Nvidia immediately promised to maintain ARM’s independence in terms of licensing its intellectual property (IP) to other IC suppliers and systems makers. The acquisition is expected to be completed by March 2022, but must win clearance from regulatory agencies in the U.S., U.K., European Union, South Korea, Japan, and China.

Four weeks after Nvidia announced the largest semiconductor acquisition in history, more large M&A agreements were announced in October 2020. It started with Intel announcing the sale of its NAND flash memory business and 300mm wafer fab in China to SK Hynix in South Korea for USD 9 billion. In the last week of October 2020, Advanced Micro Device announced an agreement to buy programmable logic leader Xilinx for about USD 35 billion in stock. This deal is scheduled to be completed by the end of this year. Also at the end of October, Marvell Technology announced it would acquire high-speed interconnect and mixed-signal IC supplier Inphi in Silicon Valley for USD 10 billion in stock and cash. The acquisition is expected to close in the second half of 2021.

It is important to note that IC Insights’ M&A list covers purchase agreements for semiconductor companies, business units, product lines, chip intellectual property (IP), and wafer fabs, but it excludes acquisitions of software and system-level businesses by IC companies. For instance, the M&A list excludes Intel’s $900 million acquisition of mobile-application software supplier Moovit in Israel in May 2020. Moovit’s urban mobility software apps will be used by Intel to increase its capability to automate ground travel and planning with Internet connections, but the Israeli startup is not a semiconductor company. IC Insights’ acquisition list also excludes transactions between semiconductor capital equipment suppliers, material producers, chip packaging and testing companies, and design-automation software firms.

As in recent years, semiconductor acquisitions in 2020 were driven by large IC companies looking to sharpen their positions in emerging and high-growth market opportunities, such as embedded machine-learning and AI capabilities, self-driving cars, all-electric vehicles, expansion of data centers for cloud-computing services and proliferation of the sensors and systems connected to Internet of Things. Industry consolidation also continued to play a key role in many of the 2020 acquisition agreements.

The top-five acquisition agreements in 2020 were among the largest of the 51 semiconductor M&A deals made over the past 21 years that were valued at USD 1.0 billion or more. Three of the 2020 agreements rank in the top five with No. 1 being Nvidia’s USD 40 billion bid for ARM, No. 3 being AMD’s planned USD 35 billion purchase of Xilinx, and No. 5 being Analog Devices’ move to buy Maxim for USD 21 billion. More than half of the top 51 semiconductor industry acquisition agreements—32 of them—have occurred in the past six years (2015-2020).