© adam121 dreamstime.com

Analysis |

Contingency plans needed for purchasing managers

Shortages in components, materials, labor and infrastructure (electricity, water) are restraining capacity and reallocating profit margins.

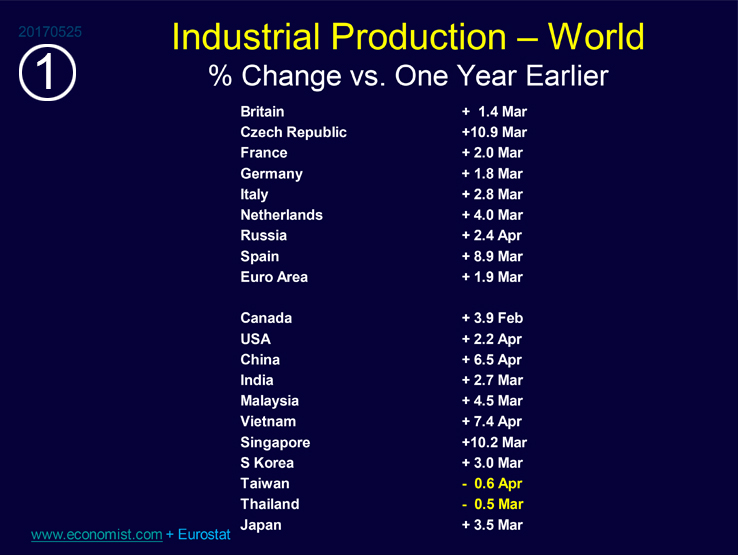

The global economic expansion seems to be picking up steam in spite of the geopolitical threats and disruptions. Long awaited price increases are coming from component shortages, labor cost increases and infrastructure instability. Global industrial production has been expanding annually throughout most of the developed countries (Chart 1) and global annual GDP growth is expected to grow 2.5% in 2017 and 2.6% in 2018 (Chart 2).

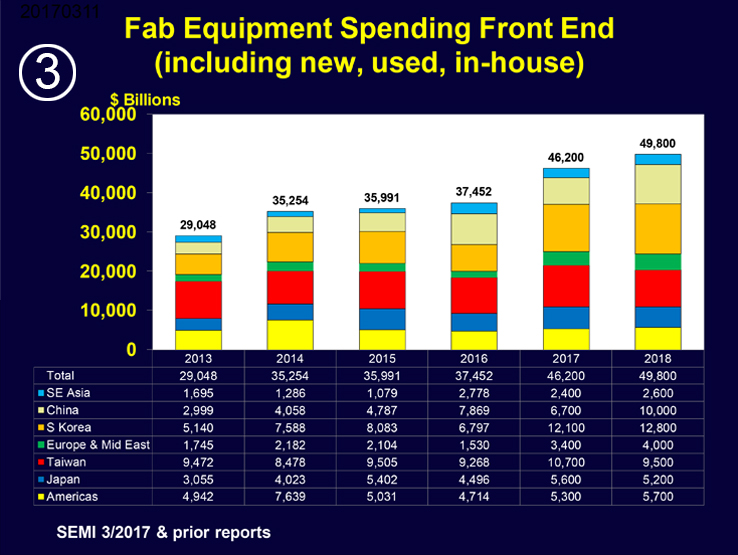

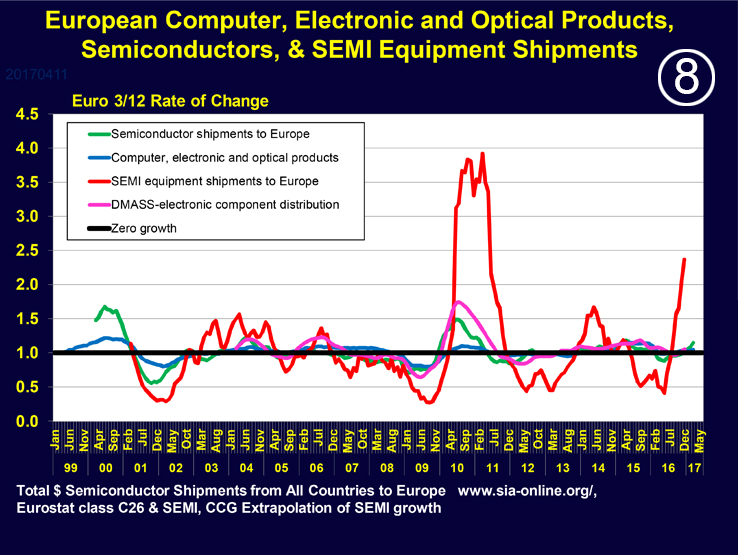

Supply chain imbalances are threatening to affect electronic equipment shortages and are putting price pressure on manufacturers. Phison Electronics management is worried that memory chip shortages will restrict revenue growth as the semiconductor-grade silicon wafer supply is anticipated to remain tight through 2019. Fab (front end) equipment spending is expected to almost double annually in South Korea in 2017 and SEMI sees Europe and the Middle East Fab expansion growing from 1.5 billion in 2016 to almost 3.5 billion in 2017 (chart 3).

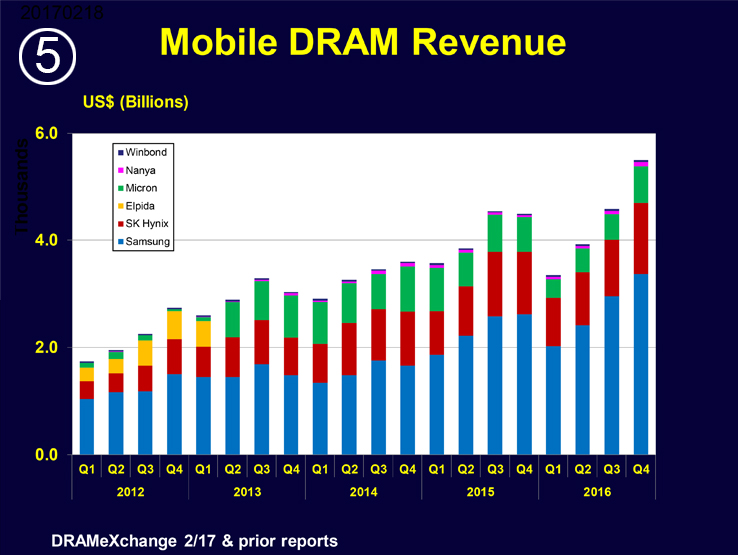

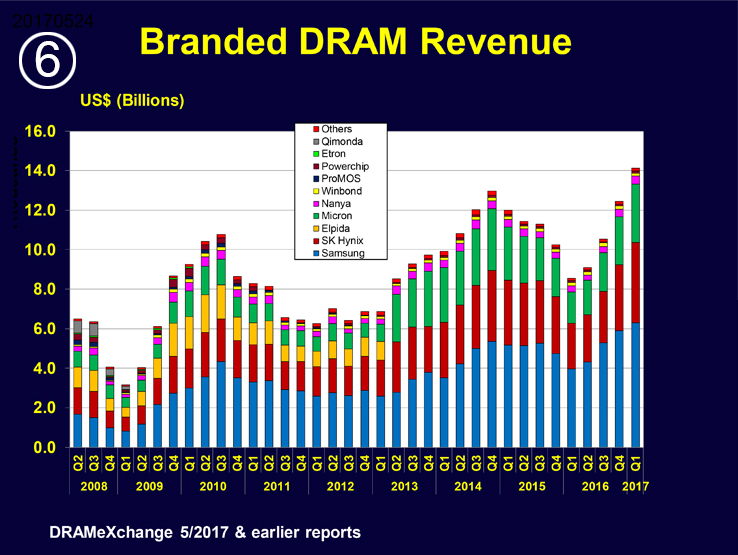

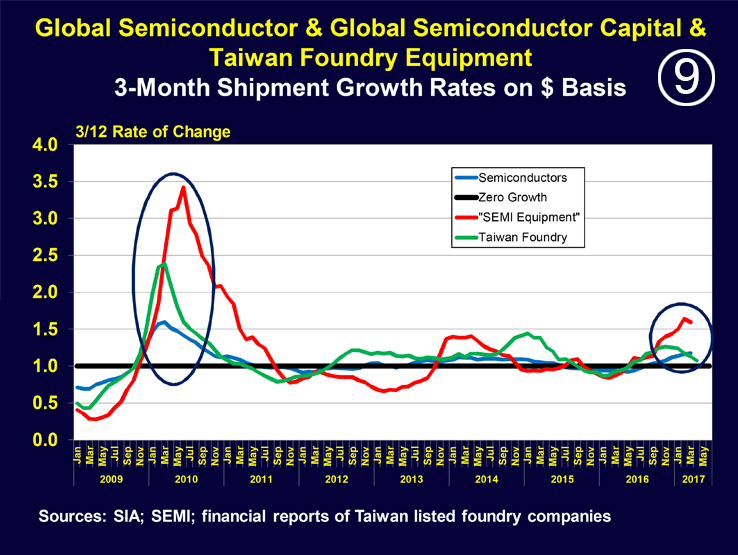

UMC vice president of business management, Walter Ng, sees 200 mm capacity remaining fully utilized throughout 2017 as a result of 200 MM process equipment shortages. In March of 2017, total global monthly semiconductor shipments grew 18.1% y/y on a three-month average, based on US dollars (Chart 4). China’s semiconductor shipments grew 26.7%, while the Americas expanded 21.9%. Samsung’s Mobile and Branded DRAM revenue has especially benefitted from constricted supply (Chart 5 & 6).

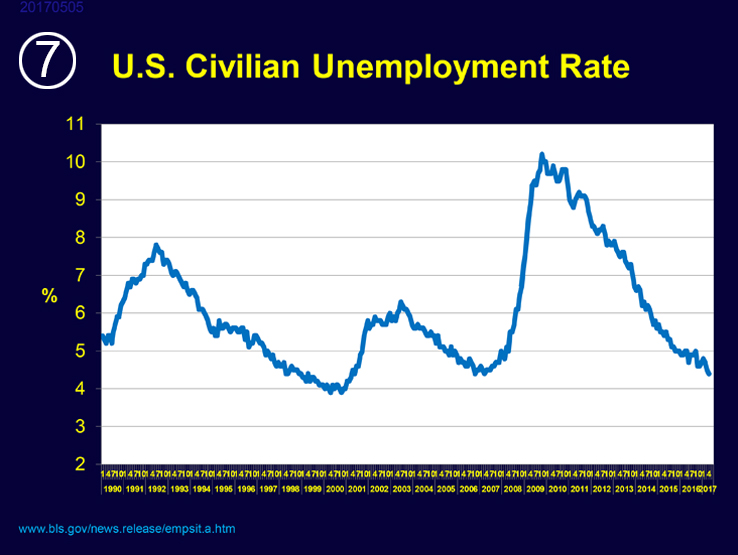

In addition to component shortages, the global expansion is dealing with a tight labor market that is resulting in labor contract disputes that are causing volatility in raw material prices. U.S. unemployment has dropped to the second lowest level in the past 17 years (Chart 7) which is increasing consumption, including durable goods.

The European economy is also growing and manufacturers are building out capacity. Semiconductor equipment shipments (Chart 8) have jumped over the past year with the Czech Republic and Spain leading year-over-year industrial production growth and powerhouses, Germany, France and Great Britain are positioning themselves for the Brexit.

Japan’s economy has also moved into growth territory and exports have risen every month since December 2016. Japan’s mid-sized manufacturing companies are looking to automation to neutralize rising labor costs, which will further strain its already strained utility grid. Taiwan’s semiconductor foundry industry is fighting to retain market share (Chart 9) that is losing to China’s massive expansion plans and is also struggling to expand capacity due to electricity and water restrictions.

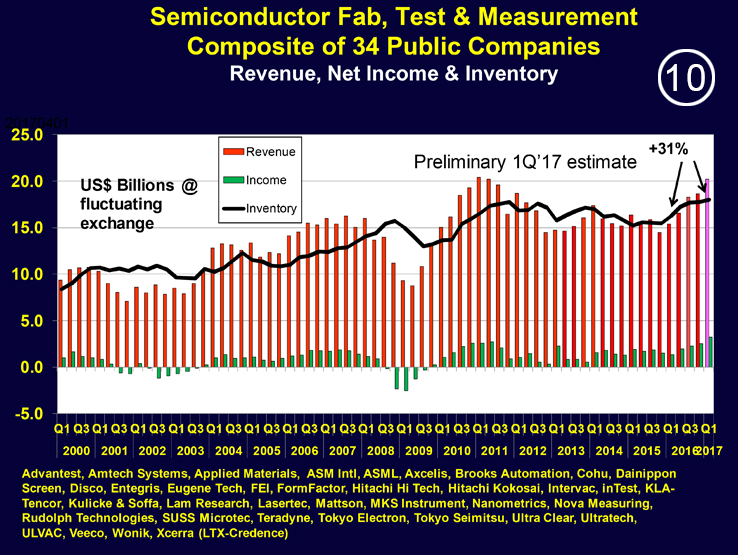

Overall, 1Q’17 revenue has increased 31% y/y based on a composite of publically traded companies (Chart 10) as a result of a synchronized global expansion driven by higher semiconductor content in automobiles, automation and internet of things.

Jonathan Custer-Topai is Vice-President of © Custer Consulting Group, which provides market research, business analyses and forecasts on a variety of subjects within the electronics indsutry.

Jonathan Custer-Topai is Vice-President of © Custer Consulting Group, which provides market research, business analyses and forecasts on a variety of subjects within the electronics indsutry.