© FBDi

Components |

German electronics components distribution finishes 2016 in growth mode

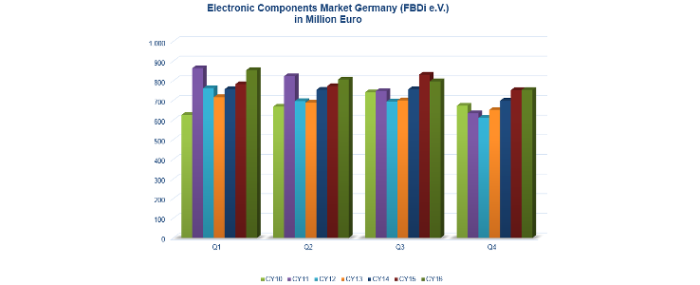

German electronic distribution market (according to FBDi association) grew by 0.2 percent in Q4/16. Full-year ended with 2.3 percent plus in turn-over. Order situation at record level.

The German component distribution market has closed a rather inconsistent 2016 with a tiny plus in the fourth quarter. The turn-over of the FBDi member companies in Germany increased by 0.2 percent to EUR 753 million. Incoming orders increased by 9 percent to EUR 854 million, which resulted in a very healthy book-to-bill ratio of 1.13. The full year ended with sales of EUR 3.21 billion (plus 2.3 percent).

Broken down by technology, semiconductors performed slightly better than average – with a plus of 2.6 percent to EUR 532 million in the fourth quarter, and a total increase in the full-year of 3.45 percent to EUR 2.26 billion. Passive components dropped by 5.3 percent to EUR 103 million in Q4/16 (2016: minus 0.2 percent to EUR 443 million). Electromechanics experienced a decline of 4 percent to EUR 68 million (2016: minus 1.6 percent to EUR 299 million). Smaller product areas like displays and sensors showed significant quarterly swings, both have dropped in a year-to-year comparison. In contrast, the turn-over of power supplies grew by 11.5 percent to EUR 85 million, compared to 2015.

For the full-year 2016 the sales breakdown of distribution turn-over shows as follows: semiconductors 70.3 percent, passive components 13.8 percent, electromechanics 9.3 percent, displays 3 percent%, sensors 0.6 percent, power supplies 2.6 percent.

FBDi Chairman of the board, Georg Steinberger: “In the end, 2016 turned out to be a little weaker than expected, some of it certainly due to margin erosion, driven by suppliers. With regard to the favorable economic conditions in Germany the question arises why the usually strong High-Tech industry is growing rather moderately. On the other hand, incoming orders show strength and resilience, at least for the beginning of 2017.”

Steinberger’s conclusion: “Considering the general modest growth in the worldwide components market, I don’t expect a strong or sustainable impulse for distribution – but quite the opposite. The pressure on distributors from producers remains unchanged, and as a matter of fact, we sense a certain ruthlessness, which will have negative effect on the distribution and also on customers’ choices in the end.”