Components |

Qualcomm, Micron & GlobalFoundries gain in 1Q/12 Top20 ranking

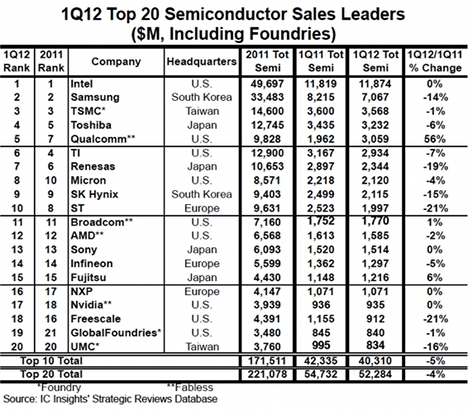

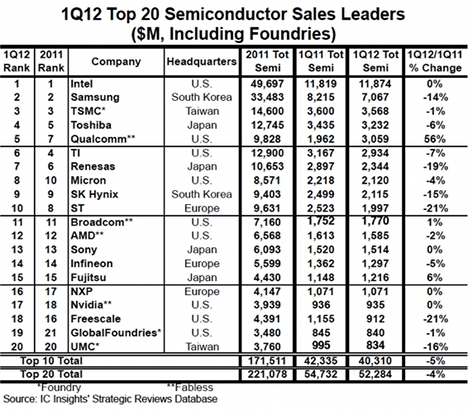

In short: Qualcomm moved into fifth place. GlobalFoundries moved into, while Elpida fell out of, the Top20.

Intel remained firmly in control of the number one spot in the ranking. In fact, Intel extended its lead over second-ranked Samsung by registering a 68% higher sales level than Samsung in 1Q12 as compared to a 48% margin for all of 2011.

GlobalFoundries 1Q12/1Q11 sales declined by 1%, but it replaced Elpida, whose 1Q12/1Q11 sales dropped by 34%, in the top 20 ranking. It currently appears that Micron has the best chance to eventually acquire Elpida out of bankruptcy. If this occurs, Micron would add between $2.5 and $3.0 billion in revenue to its annual sales, which could help move the company up one or two positions in the ranking.

There are now three pure-play foundries in the top 20 ranking. If these three foundry companies were excluded, Sharp, Marvell, and Rohm would have been included in the 1Q12 top 20 listing.

© IC Insights

In total, the top 20 semiconductor suppliers showed a 4% decline in 1Q12 sales as compared to 1Q11. This growth rate is 10 points less than IC Insights’ full-year 2012/2011 worldwide semiconductor market growth forecast of 6%. Thus, while 1Q12 semiconductor sales results from most of the top 20 companies were generally disappointing, IC Insights, and most of the top 20 semiconductor companies themselves, expect much better sequential quarterly sales performance to be demonstrated starting in 2Q12. IC Insights forecasts that the 2Q12/1Q12 worldwide semiconductor market will show a 6% increase, followed by even stronger sequential growth in 3Q12.

There was a wide range of year-over-year growth rates among the top 20 semiconductor suppliers in 1Q12. It should be noted that the memory companies did not secure any of the top 10 growth rate positions. In fact, only three companies registered better than flat 1Q12/1Q11 growth rates—Qualcomm, Fujitsu, and Broadcom.

Fabless semiconductor supplier Qualcomm rode the strong wave of high growth in the smartphone marketplace to post a stellar 56% year-over-year surge in semiconductor sales. This amazing increase was also spurred in part by the company’s acquisition of Atheros in May of 2011. In fact, Qualcomm is now on pace to register over $12 billion in sales this year! In contrast to Qualcomm, each of the big four memory suppliers in the top 20 ranking (i.e., Samsung, Toshiba, SK Hynix, and Micron) registered 1Q12/1Q11 sales declines with Samsung and SK Hynix logging double-digit drops.

Overall, it appears the bottom of the semiconductor market slowdown occurred for the majority of the top 20 companies in either 4Q11 or 1Q12. If the worldwide economy can at least continue on its slow growth rate trajectory and not slip back into a recession, the remainder of 2012 looks bright for the semiconductor industry and its suppliers.

© IC Insights

In total, the top 20 semiconductor suppliers showed a 4% decline in 1Q12 sales as compared to 1Q11. This growth rate is 10 points less than IC Insights’ full-year 2012/2011 worldwide semiconductor market growth forecast of 6%. Thus, while 1Q12 semiconductor sales results from most of the top 20 companies were generally disappointing, IC Insights, and most of the top 20 semiconductor companies themselves, expect much better sequential quarterly sales performance to be demonstrated starting in 2Q12. IC Insights forecasts that the 2Q12/1Q12 worldwide semiconductor market will show a 6% increase, followed by even stronger sequential growth in 3Q12.

There was a wide range of year-over-year growth rates among the top 20 semiconductor suppliers in 1Q12. It should be noted that the memory companies did not secure any of the top 10 growth rate positions. In fact, only three companies registered better than flat 1Q12/1Q11 growth rates—Qualcomm, Fujitsu, and Broadcom.

Fabless semiconductor supplier Qualcomm rode the strong wave of high growth in the smartphone marketplace to post a stellar 56% year-over-year surge in semiconductor sales. This amazing increase was also spurred in part by the company’s acquisition of Atheros in May of 2011. In fact, Qualcomm is now on pace to register over $12 billion in sales this year! In contrast to Qualcomm, each of the big four memory suppliers in the top 20 ranking (i.e., Samsung, Toshiba, SK Hynix, and Micron) registered 1Q12/1Q11 sales declines with Samsung and SK Hynix logging double-digit drops.

Overall, it appears the bottom of the semiconductor market slowdown occurred for the majority of the top 20 companies in either 4Q11 or 1Q12. If the worldwide economy can at least continue on its slow growth rate trajectory and not slip back into a recession, the remainder of 2012 looks bright for the semiconductor industry and its suppliers.

© IC Insights

In total, the top 20 semiconductor suppliers showed a 4% decline in 1Q12 sales as compared to 1Q11. This growth rate is 10 points less than IC Insights’ full-year 2012/2011 worldwide semiconductor market growth forecast of 6%. Thus, while 1Q12 semiconductor sales results from most of the top 20 companies were generally disappointing, IC Insights, and most of the top 20 semiconductor companies themselves, expect much better sequential quarterly sales performance to be demonstrated starting in 2Q12. IC Insights forecasts that the 2Q12/1Q12 worldwide semiconductor market will show a 6% increase, followed by even stronger sequential growth in 3Q12.

There was a wide range of year-over-year growth rates among the top 20 semiconductor suppliers in 1Q12. It should be noted that the memory companies did not secure any of the top 10 growth rate positions. In fact, only three companies registered better than flat 1Q12/1Q11 growth rates—Qualcomm, Fujitsu, and Broadcom.

Fabless semiconductor supplier Qualcomm rode the strong wave of high growth in the smartphone marketplace to post a stellar 56% year-over-year surge in semiconductor sales. This amazing increase was also spurred in part by the company’s acquisition of Atheros in May of 2011. In fact, Qualcomm is now on pace to register over $12 billion in sales this year! In contrast to Qualcomm, each of the big four memory suppliers in the top 20 ranking (i.e., Samsung, Toshiba, SK Hynix, and Micron) registered 1Q12/1Q11 sales declines with Samsung and SK Hynix logging double-digit drops.

Overall, it appears the bottom of the semiconductor market slowdown occurred for the majority of the top 20 companies in either 4Q11 or 1Q12. If the worldwide economy can at least continue on its slow growth rate trajectory and not slip back into a recession, the remainder of 2012 looks bright for the semiconductor industry and its suppliers.

© IC Insights

In total, the top 20 semiconductor suppliers showed a 4% decline in 1Q12 sales as compared to 1Q11. This growth rate is 10 points less than IC Insights’ full-year 2012/2011 worldwide semiconductor market growth forecast of 6%. Thus, while 1Q12 semiconductor sales results from most of the top 20 companies were generally disappointing, IC Insights, and most of the top 20 semiconductor companies themselves, expect much better sequential quarterly sales performance to be demonstrated starting in 2Q12. IC Insights forecasts that the 2Q12/1Q12 worldwide semiconductor market will show a 6% increase, followed by even stronger sequential growth in 3Q12.

There was a wide range of year-over-year growth rates among the top 20 semiconductor suppliers in 1Q12. It should be noted that the memory companies did not secure any of the top 10 growth rate positions. In fact, only three companies registered better than flat 1Q12/1Q11 growth rates—Qualcomm, Fujitsu, and Broadcom.

Fabless semiconductor supplier Qualcomm rode the strong wave of high growth in the smartphone marketplace to post a stellar 56% year-over-year surge in semiconductor sales. This amazing increase was also spurred in part by the company’s acquisition of Atheros in May of 2011. In fact, Qualcomm is now on pace to register over $12 billion in sales this year! In contrast to Qualcomm, each of the big four memory suppliers in the top 20 ranking (i.e., Samsung, Toshiba, SK Hynix, and Micron) registered 1Q12/1Q11 sales declines with Samsung and SK Hynix logging double-digit drops.

Overall, it appears the bottom of the semiconductor market slowdown occurred for the majority of the top 20 companies in either 4Q11 or 1Q12. If the worldwide economy can at least continue on its slow growth rate trajectory and not slip back into a recession, the remainder of 2012 looks bright for the semiconductor industry and its suppliers.