© fbdi

Analysis |

Component distribution off to a positive start

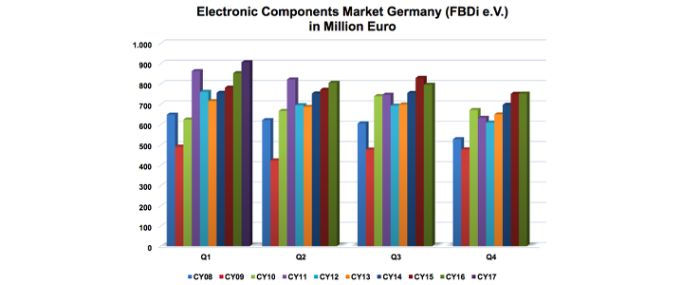

The German component distribution market (according to FBDi e.V.) grew 6.3 percent in the first quarter, while orders soared 20 percent.

Component distributors in Germany enjoyed a highly successful start of the new financial year. After a rather mediocre 2016, sales by companies registered with the Fachverband Bauelemente Distribution (FBDi e.V.) in Germany grew 6.3 percent to reach EUR 907 million during the first quarter - a record result. The prospects for the upcoming quarters are even more promising, as orders have jumped 20 percent to over EUR 1 billion. The book-to-bill rate was 1.11.

The top performer among the product segments is electromechanics, which grew by almost 13 percent to EUR 91 million, followed by passive components, which rose 7.5 percent to reach EUR 122 million. Semiconductors climbed to EUR 635 million (+5.9%). Power supplies also recorded double-digit growth of 12.2 percent to reach EUR 25 million. Displays and sensors performed rather less well, with both items recording falls in the double-digit range. The breakdown of component types remained largely unchanged with semiconductors accounting for 70 percent, passive 13 percent, electromechanics 10 percent, power supplies 3 percent, and the remainder spread across other components and assemblies.

FBDi Chairman of the Board Georg Steinberger remarked: "This is a strong start that is set to improve further thanks to the excellent order situation. The overall position of the German high-tech industry is even better since its electronics manufacturing activities are focused to a large extent in lower-cost regions of Eastern Europe. Perceived growth among customers in the first quarter is leaning more toward double-digits.”

Naturally, there are ongoing risks, Steinberger added: "We suspect that increasing delivery times in the semiconductor industry and the generally high workload at factories is leading to duplicate bookings. The year 2017 will also continue to be dominated by price increases by the manufacturers. The fact that more and more semiconductor components are single-source products is significantly restricting customer choice and therefore the potential for negotiation. Many manufacturers are also constricting their sales channels or attempting to supply typical distribution customers themselves – a move that will not necessarily lead to a more customer-friendly service."

In addition, policies and their product-relevant decisions and directives are likely to cause rather more substantial difficulties in 2017. Steinberger adds: "As if the administrative burden posed by RoHS, WEEE or conflict minerals were not already significant enough, the FBDi believes that the amendment to the Chemicals Regulation by the EU Commission and ECHA (European Chemicals Agency) will result in a complete disaster and will impose a duty of disclosure on the entire electronics industry, that merely represents the collateral damage of the Chemicals Regulation. Simply put - it is impossible to trace and administer information across hundreds of substances and millions of different products, extending all the way down to the materials chips and capacitors are made of. Even installing a chemical laboratory in every logistics centre would not solve the problem."