© ra2studio dreamstime.com

Analysis |

2016 IC market: Cautious expectations

Improving but moderate growth as economies struggle to gain momentum.

The health of the IC industry is increasingly tied to the health of the worldwide economy. Rarely can there be strong IC market growth without at least a “good” worldwide economy to support it. Consequently, IC Insights expects annual global IC market growth rates to closely track the performance of worldwide GDP growth.

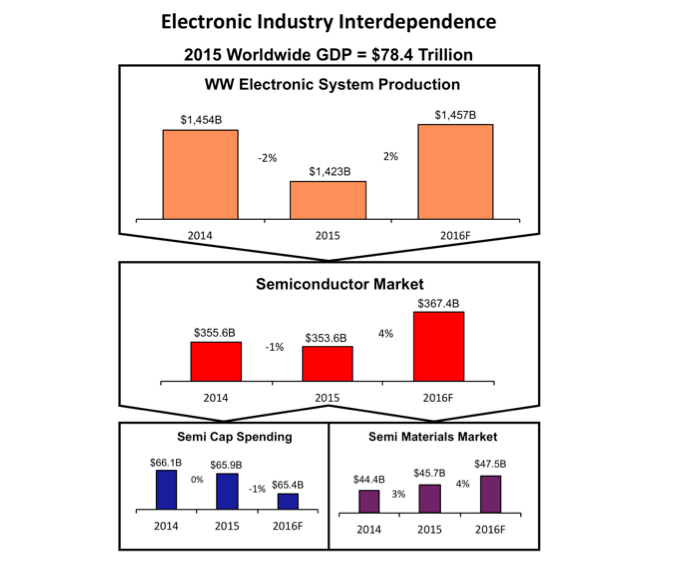

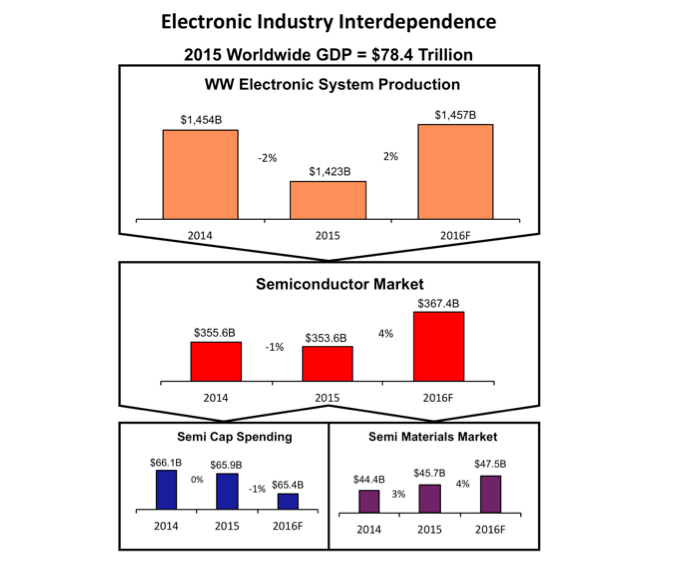

The table puts the worldwide electronics and semiconductor industries into perspective. The top figure, worldwide GDP, represents all global economic activity. Essentially, the worldwide total available market (TAM) for business (i.e., GDP) was USD 78.4 trillion in 2015.

In many areas of the world, local economies have slowed. For example, economic growth in China slipped below 7 percent in 2015. China, which is the leading market for personal computers, digital TVs, smartphones, new commercial aircraft, and automobiles, is forecast to lose more economic momentum in 2016. Its GDP is forecast to increase 6.3% in 2016, which continues a slide in that country’s annual GDP growth rate that started in 2010.

While the U.S. economy is far from perfect, it is currently one of the most significant positive driving forces in the worldwide economy. The U.S. accounted for 22 percent of worldwide GDP in 2015. U.S. GDP is forecast to grow 2.5 percent in 2016. Given its size and strength, the U.S. economy greatly influences overall global GDP growth. An improving employment picture and the low price of oil are factors that should positively impact the U.S. economy in 2016.

Other noteworthy industry highlights

-----

More can be read at © IC Insights

-----

More can be read at © IC Insights

- Global semiconductor sales decreased 1% in 2015 but are forecast to grow 4% in 2016. IC Insights expects the worldwide IC market to increase 4% in 2016, and sales of optoelectronics, sensors, and discrete (OSD) devices collectively to register 5% growth.

- Total semiconductor unit shipments (including IC and OSD devices) reached almost 840-billion units in 2015 and are expected to exceed one trillion units in 2018. After increasing 4% in 2015, IC unit shipments are forecast to grow 5% in 2016. Analog devices are forecast to account for 53% of total IC unit shipments in 2016.

- A stable IC pricing environment is expected through 2020 due in part to fewer suppliers in various IC markets (i.e., DRAM, MPU, etc.), lower capital spending as a percent of sales, and no significant new IC manufacturers entering the market in the future (the surge of Chinese IC companies that entered the market in the early 2000’s is assumed to be the last large group of newcomers.

- Semiconductor industry capital spending grew to $65.9 billion in 2015. IC Insights forecasts semiconductor capital spending will decrease 1% in 2016. Spending on flash memory and within the foundry segment is forecast to increase in 2016 but spending for all other market segments, including DRAM, is expected to decline. Semiconductor capital spending as a percent of sales is forecast to remain in the mid- to high-teens range through 2020. IC Insights believes spending at this level will not lead to an industry-wide overcapacity during the forecast period.

- Semiconductor R&D spending increased 1% in 2015 to new record high of $56.4 billion. Intel dedicated $12.1 billion to R&D in 2015 (24.0% of sales) to remain the largest semiconductor R&D spender in 2015. R&D spending at TSMC, the industry’s biggest pure-play foundry rose 10% in 2015, ranking it 5th among top R&D spenders. TSMC joined the group of top-10 R&D spenders for the first time in 2010, giving an indication of just how important TSMC and other pure-play foundries have become to the IC industry with continuing technological progress.

-----

More can be read at © IC Insights

-----

More can be read at © IC Insights