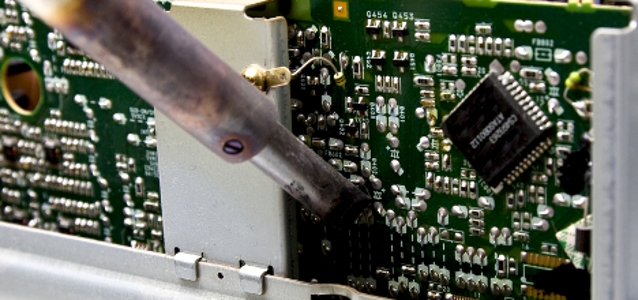

© mirusiek dreamstime.com

Analysis |

Continental and Robert Bosch battle for Top position

According to analysis by Semicast Research, Continental and Robert Bosch maintained their positions as the dominant suppliers of automotive under-the-hood ECU electronics in 2013, considerably ahead of third placed Denso.

Collectively these three suppliers are estimated to account for half of the automotive under-the-hood ECU electronics market.

Semicast defines automotive under-the-hood ECU electronics to include body, chassis, powertrain, safety and security applications, but excludes audio, infotainment, embedded navigation and embedded telematics (which are covered in a separate study on automotive entertainment systems).

The under-the-hood ECU electronics market continues to be dominated by Continental and Robert Bosch, which together accounted for an estimated forty percent of global revenues in 2013; Denso was the only other supplier with an estimated market share of more than ten percent in 2013, although its market share was impacted by a twenty percent fall in the value of the yen against the US dollar. Beyond the top three the supplier base fragments significantly, with three companies each holding an estimated market share of around four percent and then a further six suppliers each holding a share of between 2%-3.5%.

The automotive under-the-hood ECU electronics market is estimated to have been worth USD 44.8 billion in 2013 and is forecast to grow to USD 77 billion in 2020, a CAGR of eight percent. Semicast forecasts global light vehicle production volumes to grow over this period from 82 million to 106 million. However more than forty percent of the increase in global light vehicle production is forecast for China alone, with China clearly the engine of growth for global light vehicle production volumes.

A key factor which is forecast to bring sustained growth to the automotive under-the-hood ECU electronics market is the continued pervasion of electronics into almost all of the main systems in the vehicle. Automakers remain committed to the adoption of intelligent electronics which make their vehicles safer to drive and more environmentally friendly and this trend is most apparent in the emergence of hybrid vehicles.

Colin Barnden, Principal Analyst at Semicast Research and study author, commented “Semicast forecasts global hybrid light vehicle production to rise from 14.3 million in 2013 to 70.5 million in 2020, while production of electric vehicles is forecast to rise from 0.4 million to almost 4 million over the same period.”

2013 Automotive Under-the-hood ECU Electronics Vendor Share Ranking

- Continental 20.0%

- Robert Bosch 20.0%

- Denso 11.5%

- Delphi 4.0%

- Hitachi Automotive Systems 4.0%

- TRW Automotive 4.0%

- Brose 3.5%

- Valeo 2.5%

- Aisin 2.5%

- Magneti Marelli 2.5%