© handmadepictures-dreamstime.com

PCB |

Market update on the PCB industry for Q4 2013

2013 was a - by looking at the facts - a rather good year for the global flexible PCB market, which grew by 9.4% YoY and is valued at approximately EUR 8.26 billion.

Printed Circuit Boards (PCB) lie at the heart of every electrical system providing for the interconnection of circuit integration and other electronic components. The multi-layered platform that are composed of laminated materials have grown to be of great significance, sourcing for a global demand in the manufacturing of a wide range of PCBs comprising of various materials, layers and flexible consistencies.

The year 2013 was evidently prosperous for the global Flexible Printed Circuit Board market which grew by 9.4% year-on-year being valued at approximately EUR 8.26 billion. Japan maintained its dominant position in terms of revenues being earned of EUR 3.79 billion followed by South Korea and Taiwan. The spurt in growth is rooted by the increase in the development of products requiring displays involving both LCD panels and touch screen technologies. It is therefore forecasted that the Flexible Printed Circuit Board market will continue to signal positive results with an estimated market value of EUR 8.86 billion.

The German PCB market as a whole grew by 1.7% till November 2013, which was stimulated particularly through strong performances by smaller enterprises along with good health being recorded by the automotive and industrial electronics sectors, which serve as the main PCB customers. It was reported that the overall Electronic industry in Germany recorded a total revenue of EUR 166 billion in 2013.

The image has a zoom function.

Deal flow was prevalent towards the last quarter of 2013 and into the early days of 2014, with the highlight being the acquisition of Ramaer by the Italian PCB producer Elco, which was exclusively advised by MPCF on the sellside. Another cross-border transaction that was successfully executed was the acquisition of the UK-based Exception PCB by Shenzhen Fastprint Circuit Tech for a consideration of EUR 5.16 million.

The image has a zoom function.

Deal flow was prevalent towards the last quarter of 2013 and into the early days of 2014, with the highlight being the acquisition of Ramaer by the Italian PCB producer Elco, which was exclusively advised by MPCF on the sellside. Another cross-border transaction that was successfully executed was the acquisition of the UK-based Exception PCB by Shenzhen Fastprint Circuit Tech for a consideration of EUR 5.16 million.

The image has a zoom function.

Deal flow was prevalent towards the last quarter of 2013 and into the early days of 2014, with the highlight being the acquisition of Ramaer by the Italian PCB producer Elco, which was exclusively advised by MPCF on the sellside. Another cross-border transaction that was successfully executed was the acquisition of the UK-based Exception PCB by Shenzhen Fastprint Circuit Tech for a consideration of EUR 5.16 million.

The image has a zoom function.

Deal flow was prevalent towards the last quarter of 2013 and into the early days of 2014, with the highlight being the acquisition of Ramaer by the Italian PCB producer Elco, which was exclusively advised by MPCF on the sellside. Another cross-border transaction that was successfully executed was the acquisition of the UK-based Exception PCB by Shenzhen Fastprint Circuit Tech for a consideration of EUR 5.16 million.

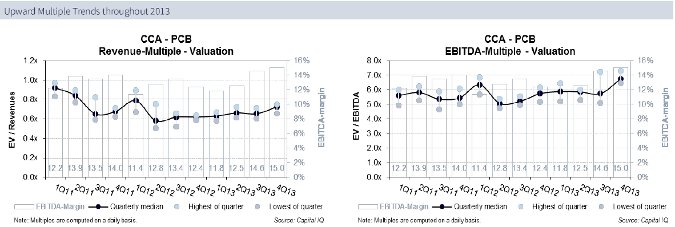

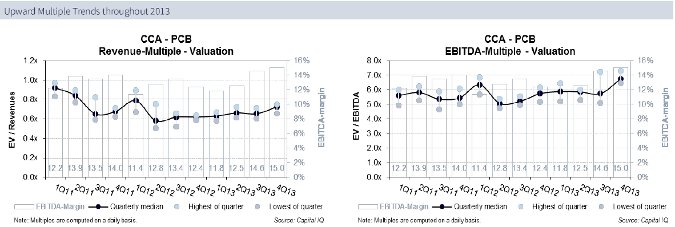

The MPCF Peer group consists of 10 global constituents with a majority of publicly traded firms originating from Asia due to the geographic dominance of the PCB market, which is driven by macroeconomic factors of productions along with technological competencies. Given the peculiarities of the PCB market, the MPCF Index illustrates an underperformance when compared to the two respective benchmark stock market indices. Nevertheless, broader market movements are reflected and impacted by the constituencies. With regards to the multiple developments, it is possible to observe an upward trend in both Revenue and EBITDA-multiples commencing from the second quarter of 2012 onwards. Lastly, it can be implicitly assumed that as the demand for electronic products increases as well as the development of wider product ranges being established, the necessity for PCBs shall subsequently grow. From an M&A perspective this can be portrayed as a stimulant in the market for cross-border transactions due to technological and strategic purposes, with possible vertical supply chain integration taking place. All images © MP Corporate Finance Group