PCB |

AT&S reaffirms positive outlook

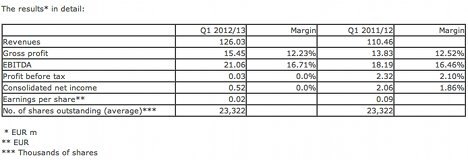

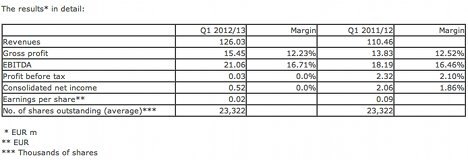

The introduction of new models, product launches and declining sales at some Mobile Devices customers all had an impact on AT&S Group’s performance in the first quarter. Revenues were up by 14% and the EBITDA margin improved slightly.

In the first quarter of the financial year 2012/13 AT&S Group posted sales of around EUR 126m, which was EUR 16m more than in the same period last year. Earnings before interest, taxes, depreciation and amortisation (EBITDA) rose by around 17% (or EUR 3m) to EUR 21m.

“The first quarter was shaped by a series of events in the Mobile Devices segment. The introduction of new models, delayed product launches and decrease in sales experienced by some of our customers resulted in short-term capacity underutilisation at our plant in Shanghai. However, the situation eased in the first few weeks of July. Shanghai is ramping up again, the loading factor increases. We are still anticipating year-on-year improvements in revenues and profits, subject to stable macroeconomic conditions,” explains CEO Andreas Gerstenmayer.

© AT&S

Mobile Devices lagging expectations

Mobile Devices’ sales for the quarter were up on the same period last year. However, product launches and delays in the introduction of new applications had a negative impact on production in Shanghai in the second half of the quarter, which was reflected in the EBIT Margin. In light of the strong rebound in order intake in July, AT&S considers the first quarter as a transformation period. With new models coming to market, as well as the expansion of the customer base, capacity utilisation in Shanghai is returning to anticipated levels.

Industrial & Automotive business stable

In the first quarter of the financial year 2012/13 industrial and automotive business grew slightly, mainly as a result of strong demand for high-end printed circuit boards in the auto supply industry. The realignment of the Leoben plant focusing on technical niche products has proved its worth in today’s challenging business environment. Demand from major customers in the industrial sector continues to be weak. Overall, capacity utilisation in the Austrian plants was in line with expectations.

Investment activities

AT&S’s net investment fell sharply from some EUR 28m to around EUR 9m, which had a positive effect on cash flow. As the capacity in Shanghai is fully installed the investment level has decreased. Construction of the plant in Chongqing is progressing according to plan. AT&S is currently discussing future technical requirements with customers in order to be able to install the appropriate equipment.

Technological development

In recent months the demand for HDI rigid-flex printed circuit boards has risen. The first jointly series production has started in China, and further projects with major producers of smartphones and tablet PCs are in the pipeline. “AT&S sees this as an attractive growth market whose needs can only be met by a few highly specialised suppliers,” explains CEO Andreas Gerstenmayer.

© AT&S

Mobile Devices lagging expectations

Mobile Devices’ sales for the quarter were up on the same period last year. However, product launches and delays in the introduction of new applications had a negative impact on production in Shanghai in the second half of the quarter, which was reflected in the EBIT Margin. In light of the strong rebound in order intake in July, AT&S considers the first quarter as a transformation period. With new models coming to market, as well as the expansion of the customer base, capacity utilisation in Shanghai is returning to anticipated levels.

Industrial & Automotive business stable

In the first quarter of the financial year 2012/13 industrial and automotive business grew slightly, mainly as a result of strong demand for high-end printed circuit boards in the auto supply industry. The realignment of the Leoben plant focusing on technical niche products has proved its worth in today’s challenging business environment. Demand from major customers in the industrial sector continues to be weak. Overall, capacity utilisation in the Austrian plants was in line with expectations.

Investment activities

AT&S’s net investment fell sharply from some EUR 28m to around EUR 9m, which had a positive effect on cash flow. As the capacity in Shanghai is fully installed the investment level has decreased. Construction of the plant in Chongqing is progressing according to plan. AT&S is currently discussing future technical requirements with customers in order to be able to install the appropriate equipment.

Technological development

In recent months the demand for HDI rigid-flex printed circuit boards has risen. The first jointly series production has started in China, and further projects with major producers of smartphones and tablet PCs are in the pipeline. “AT&S sees this as an attractive growth market whose needs can only be met by a few highly specialised suppliers,” explains CEO Andreas Gerstenmayer.

© AT&S

Mobile Devices lagging expectations

Mobile Devices’ sales for the quarter were up on the same period last year. However, product launches and delays in the introduction of new applications had a negative impact on production in Shanghai in the second half of the quarter, which was reflected in the EBIT Margin. In light of the strong rebound in order intake in July, AT&S considers the first quarter as a transformation period. With new models coming to market, as well as the expansion of the customer base, capacity utilisation in Shanghai is returning to anticipated levels.

Industrial & Automotive business stable

In the first quarter of the financial year 2012/13 industrial and automotive business grew slightly, mainly as a result of strong demand for high-end printed circuit boards in the auto supply industry. The realignment of the Leoben plant focusing on technical niche products has proved its worth in today’s challenging business environment. Demand from major customers in the industrial sector continues to be weak. Overall, capacity utilisation in the Austrian plants was in line with expectations.

Investment activities

AT&S’s net investment fell sharply from some EUR 28m to around EUR 9m, which had a positive effect on cash flow. As the capacity in Shanghai is fully installed the investment level has decreased. Construction of the plant in Chongqing is progressing according to plan. AT&S is currently discussing future technical requirements with customers in order to be able to install the appropriate equipment.

Technological development

In recent months the demand for HDI rigid-flex printed circuit boards has risen. The first jointly series production has started in China, and further projects with major producers of smartphones and tablet PCs are in the pipeline. “AT&S sees this as an attractive growth market whose needs can only be met by a few highly specialised suppliers,” explains CEO Andreas Gerstenmayer.

© AT&S

Mobile Devices lagging expectations

Mobile Devices’ sales for the quarter were up on the same period last year. However, product launches and delays in the introduction of new applications had a negative impact on production in Shanghai in the second half of the quarter, which was reflected in the EBIT Margin. In light of the strong rebound in order intake in July, AT&S considers the first quarter as a transformation period. With new models coming to market, as well as the expansion of the customer base, capacity utilisation in Shanghai is returning to anticipated levels.

Industrial & Automotive business stable

In the first quarter of the financial year 2012/13 industrial and automotive business grew slightly, mainly as a result of strong demand for high-end printed circuit boards in the auto supply industry. The realignment of the Leoben plant focusing on technical niche products has proved its worth in today’s challenging business environment. Demand from major customers in the industrial sector continues to be weak. Overall, capacity utilisation in the Austrian plants was in line with expectations.

Investment activities

AT&S’s net investment fell sharply from some EUR 28m to around EUR 9m, which had a positive effect on cash flow. As the capacity in Shanghai is fully installed the investment level has decreased. Construction of the plant in Chongqing is progressing according to plan. AT&S is currently discussing future technical requirements with customers in order to be able to install the appropriate equipment.

Technological development

In recent months the demand for HDI rigid-flex printed circuit boards has risen. The first jointly series production has started in China, and further projects with major producers of smartphones and tablet PCs are in the pipeline. “AT&S sees this as an attractive growth market whose needs can only be met by a few highly specialised suppliers,” explains CEO Andreas Gerstenmayer.