© IHS iSuppli

Electronics Production |

Japan: Global MEMS industry is relatively unaffected

Nearly two months after the Japan quake and tsunami wreaked havoc on the world’s industrial supply chains, the global microelectromechanical system (MEMS) industry is back on its feet, emerging relatively unscathed after the disaster, states IHS iSuppli.

“To date, the supply of MEMS sensors and actuators remains only slightly affected by the Japan catastrophe,” said Jérémie Bouchaud, director and principal analyst for MEMS at IHS. “In fact, the main effect of the earthquake on the world MEMS industry is on the demand side, not on supply. Manufacturers of finished electronic products have been more severely impacted than the component suppliers.”

MEMS devices are used in popular consumer electronic products like smart phones and tablets, and MEMS sensors also find their way into applications for the industrial, automotive, medical and aerospace sectors. Given that nine out of the top 50 MEMS manufacturers worldwide are Japanese companies, and with Japan serving as a strong manufacturing base for MEMS companies headquartered in Western countries, the world’s third-largest economy occupies a central position in the production and supply of MEMS.

Japanese companies sold some USD 1.38 billion worth of MEMS in 2010, representing 21.3% of the global market. Japanese firms Canon, Panasonic, Epson and Denso all rank among the Top 20 in the global MEMS space.

Approximately 32.5% of MEMS sensors and actuators in value were processed—either partly or entirely—in Japanese facilities in 2010, corresponding to revenues from both Japanese MEMS companies and from foreign companies that have their MEMS processed in Japan. Western companies with MEMS facilities in Japan include Freescale Semiconductor, Knowles Electronics, Goodrich Corp. and Texas Instruments Inc. for the Complementary Metal-Oxide Semiconductor (CMOS) circuitry of its Digital Light Processing (DLP) chipsets.

Furthermore, Japan makes nearly all of the world’s digital compasses. Compasses rapidly are becoming a standard feature in tablets and cell phones equipped with global positioning system (GPS) functionality. Worldwide shipments of digital compasses reached 263 million units in 2010, up 354% from 58 million the earlier year, with shipments expected to rocket to 1.28 billion units by 2015, IHS iSuppli research indicates.

Together, four Japanese firms—AKM Semiconductor, Yamaha Corp., Aichi Steel and Alps Electric—accounted for 97% of the global supply of digital compasses.

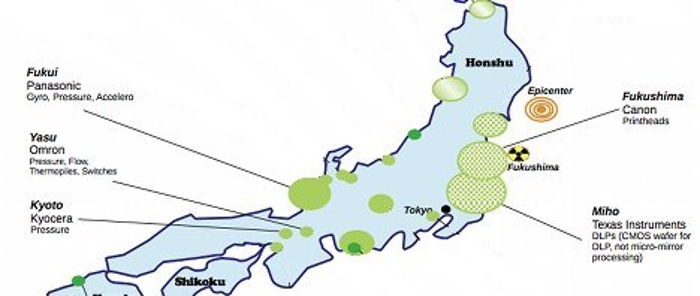

For the MEMS industry in general and for Japan’s MEMS sector in particular, the damage was not as severe as initially feared due to a fortuitous accident of geography. Most MEMS fabs and foundries are located in southern Honshu, away from the disaster-devastated northern section of the island, Bouchaud pointed out. Moreover, MEMS and compass suppliers had been employing multiple fabrication plants for manufacturing before the quake and tsunami occurred, reducing the impact of supply disruptions caused by damage to a specific factory.

Damage report: Only three fabs sustained direct damage

Only three of the 22 most important MEMS and compass fabrication plants in Japan suffered direct damage, IHS iSuppli research shows, although 19 fabs potentially could be affected by the same logistical and power issues impacting all Japanese industries in the calamity’s aftermath. The three damaged facilities belonged to Freescale, Canon Corp. and Texas Instruments, shown in the attached figure pinpointing the location of MEMS and digital compass fabrication facilities throughout Japan.

© IHS iSuppli / According to Freescale, the company has decided to close its 150-millimeter (mm) fab in Sendai, near the quake’s epicenter, and focus efforts on accelerating the transfer of MEMS production to its 200-mm Oak III fab in Texas. Freescale was lucky in that the Sendai fab had been scheduled for shutdown by the end of 2011, and the company already had built buffer inventories. Had it not made this decision in 2009, Freescale and its customers would have been severely hurt, IHS believes.

For Canon, which makes printers and MEMS print heads in the city of Fukushima, site of the nuclear meltdown, production was halted after significant damage to the company’s plant. However, Canon managed to repair the damage very quickly, with the plant completely operational again by the first week of April. As a result, the impact of the disaster on Canon’s MEMS revenue for 2011 is expected to be very modest, IHS iSuppli data indicate.

For its part, Texas Instruments’ Miho fab northeast of Tokyo has undergone the repair of various infrastructure systems for water, gases and chemicals. Full production will resume by the middle of July, with full shipment capacity to commence before September, the company said. Prior to the catastrophe, Texas Instruments already was using multiple fabs for the fabrication of CMOS wafers for DLP MEMS chips, and the company is in a fortunate position to rapidly increase production at its other fabs to compensate for the disruption at Miho.

© IHS iSuppli / According to Freescale, the company has decided to close its 150-millimeter (mm) fab in Sendai, near the quake’s epicenter, and focus efforts on accelerating the transfer of MEMS production to its 200-mm Oak III fab in Texas. Freescale was lucky in that the Sendai fab had been scheduled for shutdown by the end of 2011, and the company already had built buffer inventories. Had it not made this decision in 2009, Freescale and its customers would have been severely hurt, IHS believes.

For Canon, which makes printers and MEMS print heads in the city of Fukushima, site of the nuclear meltdown, production was halted after significant damage to the company’s plant. However, Canon managed to repair the damage very quickly, with the plant completely operational again by the first week of April. As a result, the impact of the disaster on Canon’s MEMS revenue for 2011 is expected to be very modest, IHS iSuppli data indicate.

For its part, Texas Instruments’ Miho fab northeast of Tokyo has undergone the repair of various infrastructure systems for water, gases and chemicals. Full production will resume by the middle of July, with full shipment capacity to commence before September, the company said. Prior to the catastrophe, Texas Instruments already was using multiple fabs for the fabrication of CMOS wafers for DLP MEMS chips, and the company is in a fortunate position to rapidly increase production at its other fabs to compensate for the disruption at Miho.

© IHS iSuppli / According to Freescale, the company has decided to close its 150-millimeter (mm) fab in Sendai, near the quake’s epicenter, and focus efforts on accelerating the transfer of MEMS production to its 200-mm Oak III fab in Texas. Freescale was lucky in that the Sendai fab had been scheduled for shutdown by the end of 2011, and the company already had built buffer inventories. Had it not made this decision in 2009, Freescale and its customers would have been severely hurt, IHS believes.

For Canon, which makes printers and MEMS print heads in the city of Fukushima, site of the nuclear meltdown, production was halted after significant damage to the company’s plant. However, Canon managed to repair the damage very quickly, with the plant completely operational again by the first week of April. As a result, the impact of the disaster on Canon’s MEMS revenue for 2011 is expected to be very modest, IHS iSuppli data indicate.

For its part, Texas Instruments’ Miho fab northeast of Tokyo has undergone the repair of various infrastructure systems for water, gases and chemicals. Full production will resume by the middle of July, with full shipment capacity to commence before September, the company said. Prior to the catastrophe, Texas Instruments already was using multiple fabs for the fabrication of CMOS wafers for DLP MEMS chips, and the company is in a fortunate position to rapidly increase production at its other fabs to compensate for the disruption at Miho.

© IHS iSuppli / According to Freescale, the company has decided to close its 150-millimeter (mm) fab in Sendai, near the quake’s epicenter, and focus efforts on accelerating the transfer of MEMS production to its 200-mm Oak III fab in Texas. Freescale was lucky in that the Sendai fab had been scheduled for shutdown by the end of 2011, and the company already had built buffer inventories. Had it not made this decision in 2009, Freescale and its customers would have been severely hurt, IHS believes.

For Canon, which makes printers and MEMS print heads in the city of Fukushima, site of the nuclear meltdown, production was halted after significant damage to the company’s plant. However, Canon managed to repair the damage very quickly, with the plant completely operational again by the first week of April. As a result, the impact of the disaster on Canon’s MEMS revenue for 2011 is expected to be very modest, IHS iSuppli data indicate.

For its part, Texas Instruments’ Miho fab northeast of Tokyo has undergone the repair of various infrastructure systems for water, gases and chemicals. Full production will resume by the middle of July, with full shipment capacity to commence before September, the company said. Prior to the catastrophe, Texas Instruments already was using multiple fabs for the fabrication of CMOS wafers for DLP MEMS chips, and the company is in a fortunate position to rapidly increase production at its other fabs to compensate for the disruption at Miho.