© amkor technology

Components |

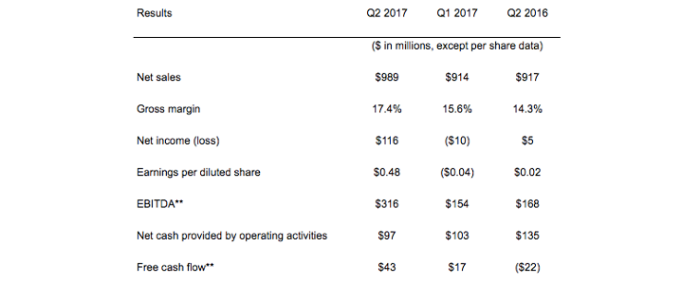

Amkor with net income of USD 116 million

Amkor Technology reported on net sales of USD 989 million for the second quarter ended June 30, 2017; a sequential and year-on-year growth of 8 percent. Net income stood at USD 116 million.

"Second quarter revenues were up 8 percent sequentially," said Steve Kelley, Amkor's president and chief executive officer. "Our growth in the quarter reflected solid demand across most end markets. In late May, we completed our acquisition of Nanium. This acquisition enhances Amkor's leadership position in wafer-level packaging, a critical technology for smartphones, tablets and other small form-factor applications."

Cash and cash equivalents were $658 million and total debt was $1.6 billion, at June 30, 2017.

"As expected, we completed the sale of our K1 factory in Korea in Q2," said Megan Faust, Amkor’s corporate vice president and chief financial officer. The sale price was USD 142 million, and we recognized an after-tax gain of USD 82 million (USD 0.34 per diluted share). We also issued a redemption notice for USD 200 million of the outstanding USD 400 million of our Senior Notes due 2021. The redemption was completed in July using cash on hand. The redemption will result in annualized interest savings of approximately USD 13 million."

Business Outlook

"Looking ahead to Q3, we expect that revenues will increase around 9% sequentially, driven by the launch of flagship mobile devices," said Kelley.

Third quarter 2017 outlook (unless otherwise noted):

- Net sales of USD 1.04 billion to 1.12 billion, up 5 to 13 percent from the prior quarter

- Gross margin of 17 to 20 percent

- Net income of USD 24 million to 64 million, or USD 0.10 to 0.27 per share

- Full year capital expenditures of around USD 525 million, up USD 25 million from the previous forecast