© tom schmucker dreamstime.com

Business |

UK: Business distress hits new record low

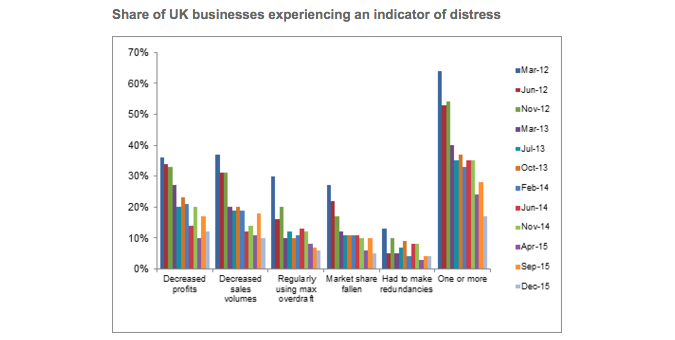

The level of business distress in the UK has hit a new record low, with just 17 percent of businesses reporting a key indicator of distress, according to new research by insolvency trade body R3.

The finding represents a sizable fall in the level of distress from the last survey in September (28 percent) and replaces the previous record low of 24 percent from April 2015.

When the survey began in March 2012, 64 percent of businesses were reporting indicators of distress.

Several of the individual indicators of distress also reported new record lows: regularly using maximum overdraft (six percent), fallen market share ( five percent) and decreased sales volumes (ten percent). Decreased profits (12 percent) and having to make redundancies (four percent) were both within two percentage points of their record lows.

Phillip Sykes, president of R3, says: “The level of businesses in distress has plummeted since our survey began in 2012. This isn’t surprising given the current state of the economy. There has been a reasonable level of growth in recent years and the record low interest rates have facilitated high liquidity.

“Reductions in fuel prices may also have cross-subsidised cost increases in other areas and assisted in keeping the pressure on costs low. These factors, combined with low inflation, are easing the difficulties of businesses.

“It’s particularly positive to see the drop in businesses experiencing decreased sales volumes and profits. Healthier profitability will help businesses stay on top of their cash flow and prevent over-reliance on credit.”

"However, the recent volatility in the stock market, driven by worries over China, could be a sign that businesses might be in for a bumpier 2016.”

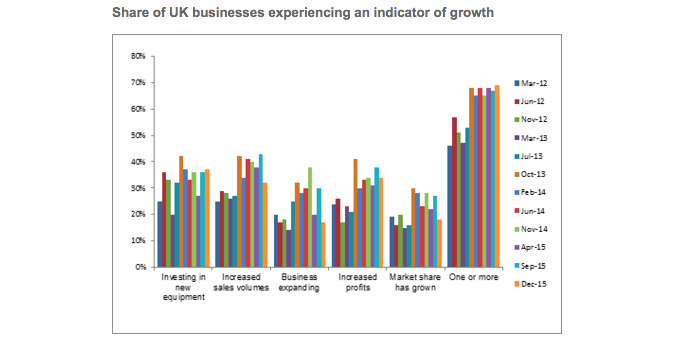

The long-running survey of UK businesses also found that growth was at a new record high. 69% of businesses reported at least one indicator of growth, a marginal increase from the previous high (68 percent) in April 2015.

Phillip Sykes continues: “While it’s positive to see the proportion of those experiencing at least one indicator is at an all-time high, the results suggest that fewer firms are seeing multiple signs of growth. Many businesses underwent a period of rapid growth in recent years, but now have started to reach a plateau.”

Smaller businesses lag behind big business

87 percent of large companies (those with 251+ employees) are experiencing indicators of growth, compared to 60 percent of sole traders.

Phillip Sykes adds: “Large companies continue to experience more signs of growth than their small counterparts, and the gap has widened since the last survey.

“It will be interesting to see the impact incoming legislation, such as auto-enrolment and the introduction of a National Living Wage, will have on companies. The changes will be a much heavier burden for smaller businesses to bear, so we may see this disparity grow further.”

-----

© BDRC Continental_R3-research