Components |

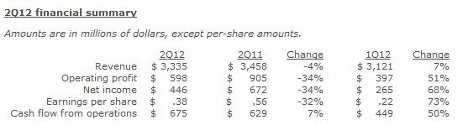

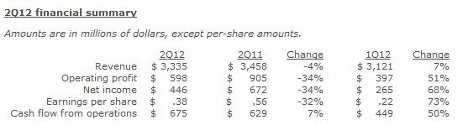

34 percent lower for Texas

Texas Instruments operating profits was 34% lower for Q2 than it was for the same quarter a year ago.

"TI revenue in the second quarter was about as we had expected," said Rich Templeton, TI's chairman, president and CEO. "Our Analog and Embedded Processing segments grew sequentially, while our Wireless segment declined.

"Although we believe customers and distributors have low inventory levels, the global economic environment is causing both to become increasingly cautious in placing new orders. Our backlog grew last quarter but orders slowed in the month of June and our backlog coverage for September is lower than normal. As a result of this increased uncertainty, we currently estimate that our revenue in the third quarter will be about even with last quarter and below our seasonal average growth rate. If customer demand increases as the quarter progresses, we are ready to support higher shipments with short product lead times, a strong inventory position and available manufacturing capacity.

"In the meantime, we remain focused on strengthening our market positions in Analog and Embedded Processing. These areas are complementary and benefit from TI's extensive and expanding relationships with customers around the world. As we continue to broaden our portfolio of leadership products, especially our standard catalog products, we enhance our ability to serve these customers."

© Texas Instruments

© Texas Instruments

© Texas Instruments

© Texas Instruments